WOOLGROWERS in Western Australia could be forgiven for being underwhelmed by 2019 and dismissing their commodity's market performance as lacklustre, compared to recent previous years.

A dry autumn, a late season break, followed by a mostly dry spring, meant stubbles and pasture did not stretch as far as they normally do, so many flocks were reliant on hand feeding for extended periods.

That made maintaining flock numbers, often bolstered by previous good seasons and buoyant wool prices, hard work and often harder still to justify economically, as drought over east sucked feed grains and hay out of WA at a great rate and bumped up prices of what was left.

It also affected wool cut, with Australian Wool Testing Authority (AWTA) statistics showing January, April, July and October as the only months in 2019 where bale numbers tested at its Bibra Lake laboratory exceeded those of the previous year.

Average wool fibre diameter declined most months or remained the same as the previous year, with only June, August and September showing a micron gain, according to AWTA.

As a result, WA's wool clip in 2019 continued an ongoing trend of becoming finer each year, with more than two thirds of the wool produced in the State in 2019 measuring 19.5 micron or finer, according to AWTA.

There was 10 per cent more fine wool in the WA clip than in the national clip and only New South Wales and Queensland drought wools averaged finer and then for only some months of the year.

In July, a higher percentage of Queensland wool than WA wool measured 19.5 micron or less and for four months NSW, the hardest hit by drought, produced more fine wool than WA.

A dry year also meant more dust and burrs in the wool, so AWTA statistics showed only August, September and October as months where clean wool yields were better than corresponding months of the previous year.

The AWTA statistics confirmed what most WA woolgrowers already knew or suspected - they worked harder, paid out more and generally got less wool for their trouble in 2019.

Apart from a lucky few on one particular day, they also did not get paid the record, or near-record prices of the previous year for their wool.

So 2019 tended to lack the excitement and sense of anticipation generated by record prices being set and then reset at live auctions, as had happened in the previous two years.

But Australian Wool Exchange (AWEX) statistics show two micron price guide records were, in fact, set at the Western Wool Centre (WWC) in 2019 - 2363 cents per kilogram clean for 21 micron wool and 2333c/kg for 22 micron wool.

Both records were set on Wednesday, February 20.

It proved to be the best day of the year by far to sell a wool clip in WA.

Apart from the records, the rest of the micron price guides achieved their best prices for the year on that day, but ultimately pulled up shy of records set in August and September 2018.

February 20 year-best prices were 2450c/kg for 18 micron, 2424c/kg for 18.5 micron, 2396c/kg for 19 micron, 2423c/kg for 19.5 micron and 2372c/kg for 20 micron wools.

The Western Indicator (WI) finished February 20 at 2202c/kg, also its best price for the year.

Of the 4000 bales offered that day, 3769 were sold - only 5.8 per cent were passed in, either failing to reach the sellers' reserves because woolgrowers thought the market might go even higher, or failing to attract a bid because of poor quality.

The Merino cardings indicator was the only one not to hit its peak for the year at the WWC on February 20.

Woolgrowers who produced short-staple wool from six or eight-month shearings had to wait a fortnight to get their best cardings price of 1229c/kg on March 7.

But from then on, WWC prices in 2019 were pretty much set on a slippery slope - albeit a relatively gentle one.

As prices fell away, the price spread between finest and broadest wools on offer shrunk from 78c/kg on February 20 to about 60c/kg on several occasions later in the year, contracting the market by largely eliminating price differentiation between particular wools as an important purchasing determinant for some woollen mills that can now adjust processed fibre diameter by speed and tension during their spinning operation.

Occasionally, sellers were able to influence the market by withholding supply and restricting auction offerings to tiny bale numbers.

But these kicks-ups, like in the first two weeks of the current season - between the end of the financial year and the annual AWEX three-week live auction recess in July and August - were generally short interludes between market corrections and fairly consistent downward pressure.

There was a spectacular trading day on Wednesday, September 11, however, when the WI jumped 198c to 1581c/kg and the 19 to 21 micron price guides rocketed up between 219c and 235c - the biggest one-day price rises of the year - to prices ranging from 1731c/kg to 1667c/kg across the board.

The WWC wool market kicked again on Wednesday, September 25, with the WI climbing 88c to 1731c/kg and the 19-21 micron price guides finishing between 93c and 101c higher, carrying all of the fleece indicators briefly back above 1800c/kg.

But hopes of a sustained run, as had happened in the previous two years, were extinguished after just five sale days by buyers staying silent and leaving the auctioneers' as the main voices heard repeatedly in the sale room.

The passed-in rate for fleece lots almost hit 60pc on Thursday, October 3, as buyers took back control of the market and the hoped-for new orders from China failed to materialise as some woollen mills there struggled to move finished knitwear and worsted garments produced and marketed for the northern hemisphere autumn and winter.

Effectively, wool prices across the micron spectrum at the WWC began yo-yoing - down one sale day, back up the next - in April and, apart from the occasional corrections, continued to do so for most of the year.

But across the year, cumulative net falls outweighed cumulative net gains by more than 600c/kg across the micron price guides spectrum.

Despite this, in an historical context, 2019 was still a relatively good year from a price perspective.

While WWC wool prices have slid considerably from the heady heights of the previous year's records, they finished 2019 roughly where they had been 18 months ago heading up to those records, AWEX statistics show.

That is, year-end wool prices are higher than they were during notable WA wool price spikes in 2015, 2011, 2007 and 2002.

AWEX price position statistics also show the broader end of the mid-micron wool market is still very strong - in particular 22 and 23 micron at over 90pc for the past three years.

That is, current prices for 22 and 23 micron wools are better than they have been for more than 90pc of the past three years, indicating the difficulty buyers have had sourcing these wools as the WA clip fines down and with demand now outstripping supply.

Price positions for 20 and 21 micron wools are better than 33pc and 38pc respectively, but then they drop away quickly for finer micron wools.

The year started on a positive note with the WWC opening a day early on a Tuesday, in line with a new AWEX policy, so the Melbourne centre was not trading on its own after a holiday recess.

A perennial problem, the cost to the wool industry of overweight bales was raised by AWEX chief executive officer Mark Grave at the WA Shearing Industry Association (WASIA) general meeting.

WASIA president Darren Spencer pointed out opening 10 bales exceeding the maximum 204kg limit, taking wool out, repressing and reweighing at the WWC could cost a woolgrower more than the $1500 for an accurate set of new scales in the woolshed.

In February demand for top specification wools spilled over to WA, with New England Wool buying up and prepared to pay a premium for wools it could no longer source for its Italian parent company out of NSW and Victoria because of the impact of drought on wool quality there.

But the move also ignited a year-long debate on the growing need for woolgrowers to complete the voluntary National Wool Declaration (NWD) with their mulesing status if they want top price.

New England Wool only buys declared pain relief or non-mulesed wool.

National Council of Wool Selling Brokers of Australia president and Australian Wool Network managing director John Colley pointed out premiums of up to 53c/kg were being paid for declared non-mulesed wool.

China suspending wool trade with South Africa over foot-and-mouth disease concerns gave woolgrowers hope that high prices were here to stay, but a lack of finance to sustain wool traders after some big buying in February was blamed for prices sliding in March.

Australian Wool Innovation (AWI) and its most vocal critic WoolProducers Australia WPA) abandoned plans for an extraordinary meeting to resolve five outstanding issues arising from the 2018 Ernst-Young performance and governance review of AWI.

AWI and WPA reached a "consensus" agreement on four of the five outstanding E-Y recommendations and AWI committed to resolve the contentious 10-year cap on director tenure issue - which would have knocked former chairman Wal Merriman and WA director David Webster out of re-election contention - before the 2020 annual general meeting.

The last Saturday in April saw a 16-year old world shearing record smashed in the Hope family's Kojonup shearing shed before a crowd of more than 400 people counting down the Merino ewes.

Bunbury shearer Lou Brown, 31, claimed the record from his trainer Cartwright Terry by shearing 497 ewes in eight hours and in doing so became the first shearer to average less than a minute per sheep in setting the record.

The focus was back on woolgrowers filling out the NWD in May, with New England Wool, Schneider Group and Modiano Australia pointing out their buyers would not bid on wool lots that do not have a completed NWD because the wool cannot be on-sold to specific clients who demand a transparent supply chain for marketing or ethical reasons.

Ten WA woolgrowers got a glimpse of life in China on an eight-day tour hosted by Primaries of WA in July and led by Primaries general manager Andrew Lindsay and Mark Boxall.

As well as tourist sites, the group visited Nanjing wool market, the world's largest vertically integrated wool processor and manufacturer Sunshine Group and the world's largest wool top maker Tianyu Wool.

In August Elders appointed commercial sheep manager Dean Hubbard as State manager of its wool division, the first time its sheep and wool divisions in WA have been headed by the same person.

Mr Hubbard, 56, replaced Danny Burkett, who left Elders after 20 years to join Westcoast Wool & Livestock.

The WWC sale room was refurbished and the WoolEX sales data recording system updated during the annual three-week live auction recess.

The WWC began live streaming Landmark and Elders wool auctions which can be viewed online by Landmark and Elders clients anywhere in Australia.

Commodity market analyst Mecardo found WA woolgrowers trailed Eastern States woolgrowers significantly in declaring their clip either ceased-mulesed or non-mulesed - CN and NM - on the NWD.

They also trailed Eastern States' counterparts in declaring use of pain relief - PR on the NWD, Mecardo's research found.

Ten years heading the West Australian Shearing Industry Association fighting for improved conditions and greater recognition for shearers saw its president MR Spencer awarded an Australian Wool Industry Medal in Melbourne during Wool Week.

The Lake Grace shearing contractor, wool buyer and trucking contractor started a 36-year career shearing as a year 12 school holiday job.

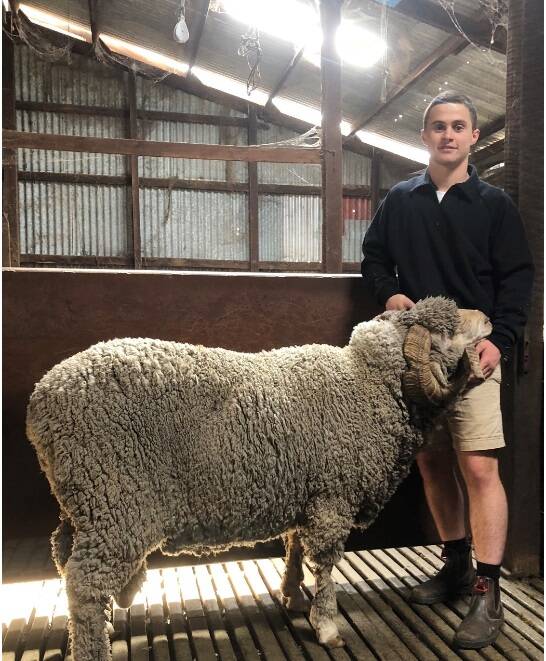

Darkan's King family were kings of the Perth Royal Show's wool section for a second year in a row in September with a ram fleece from their Rangeview Merino stud declared 2019's Supreme fleece.

It tested at 20.7 microns with a standard deviation of diameter of just 1.3 per cent and a coefficient of variation of diameter of 13.5pc, indicating how even it was.

A show fleece, it had a staple length of 140 millimetres, staple strength of 48N/kt and a washing yield of 82.2pc.

Dating back to 1857 and one of the oldest wool companies in Australia, Lempriere, ditched its dedicated buyer at the WWC in October and began using Fremantle trader PJ Morris Exports' buyer Darren Calder to bid for it.

Now part of one of the world's largest traders and processors of wool, China's Ruyi Group, Lempriere said the change was part of a "restructure" of its Australian wool buying division.

The change came a month after WWC veteran buyer Alan Brown, who had bought wool for Chinatex and Seatech, switched to buying for new Sydney-based wool trader Milewa.

For the second year in a row, the AWI annual general meeting in November provided the wool story of the month, with the 2019 meeting marking the end of Wal Merriman's sometimes controversial 15 years on the AWI board, 10 of them as its chairman.

Mr Merriman attracted plenty of votes in support but more AWI shareholders voted to oust him.

WA's only AWI board representative David Webster was returned and new directors, Riverina veterinarian Dr Michelle Humphries and Victorian stud breeder Noel Henderson, were elected.

Renewed debate about mulesing and mulesing status declarations via the NWD ended the 2019 wool year and seem likely to flow over into the new year with AWEX expected to release findings in early 2020 of a review of the NWD.

Mainstream retailers Target and Kmart joined David Jones and Country Road clothing chains and boutique clothing stores Decjuba and Forever New, in announcing they would no longer sell clothing and bedding containing wool from mulesed sheep from 2013 and 2014.

Wesfarmers' Target and Kmart stores taking a stand on mulesing effectively moves the debate out of the fly strike animal welfare versus animal rights groups and specialist Italian woollen mills arena.

They have moved mulesing into the much wider realms of ordinary consumers' market power influence and, more tellingly, potential for significant per unit margin improvements to be gained by major Chinese wool processors, garment manufacturers and retailers joining forces, jumping on the transparent supply chain bandwagon together and promoting a non-mulesed wool product.

In the end, there may not be much opportunity for debate by woolgrowers, with the ultimate decision on mulesing taken from them by public perceptions and profit margins.

That guarantees mulesing will be one of the wool industry's hot topics for 2020.