AUSTRALIAN barley production for the 2020/21 season was the second highest on record behind 2016/17, coming in at 12.7 million tonnes according to Australian Crop Forecasters.

Estimating carry in from the previous season of 2.6mt, Australian barley supply is at 15.3mt for 2020/21.

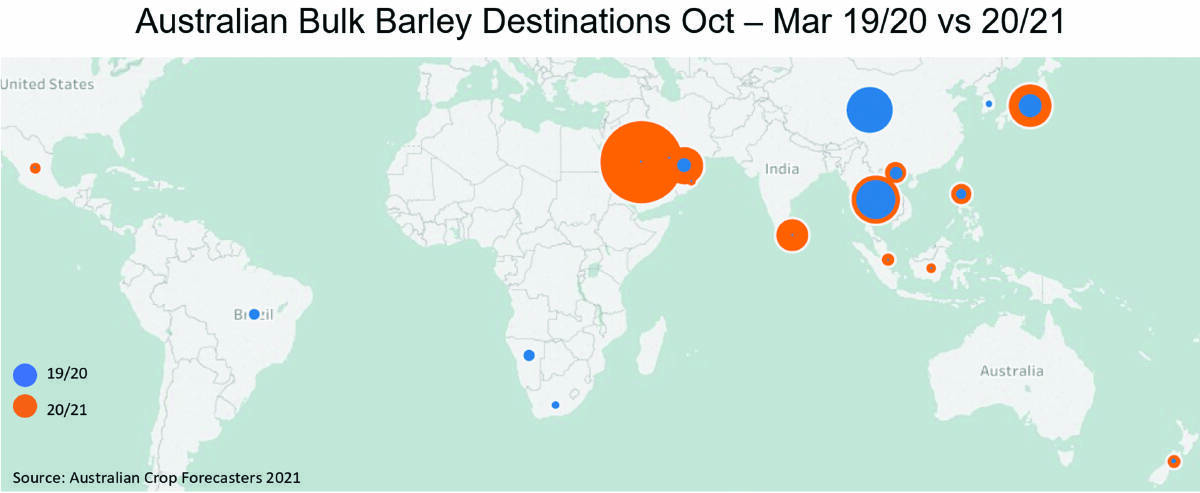

With large exportable surplus, Australian barley has been making its way into a range of export markets.

The big story in barley is increased exports to Saudi Arabia, essentially filling the gap left by China albeit feed rather than malt barley.

As you can see in the map (inset), the large orange circle shows the 1.8mt of barley that has made its way to Saudi Arabia so far this season.

When you track the export pace of barley to Saudi Arabia this year, it follows the average export pace we have seen to China over the previous five years.

While growers are not benefitting from the malt premiums we used to see from China, it is positive that Australian barley has been able to find a home in Saudi Arabia.

The larger production this past harvest has also enabled Australian barley to fill the feed grain deficit in the Asian region.

The volume of barley exported to our other top destinations in Asia has increased year-on-year.

Australian bulk handler shipping stem data shows that 615,500 tonnes of Australian barley has been exported to Thailand this marketing year along with 481,425t to Japan, that's a year-on-year increase of 35 per cent and 71pc respectively.

This high export tonnage is an indication that Australian barley is pricing competitively against other feed grains, especially corn.

Australian barley has been strongly represented in recent Saudi barley tenders.

The March 11 tender saw the Saudi Arabia Grains Organisation (SAGO) purchase 660,000 metric tonnes of barley at an average price of US$280/mt CFR (cost and freight) or about $365/mt in Australian dollar terms.

Most of this barley is likely to come from Australia as we are the cheapest origin, able to price out Russian barley as their export tax came into effect on March 15, making them less competitive.

Australian barley is in demand, especially into Saudi Arabia, but the demand profile may change mid-year when northern hemisphere crops come online.

The March European Union crop monitoring bulletin is reporting European Union 2021/22 winter barley in good condition with yields at 4.7pc above the five-year average and 9.4pc higher yields than last year.

If these yields eventuate, then Europe will be able to feed itself and potentially have exportable surplus to win back some market share that Australian barley has filled.

Attention is now turning toward the upcoming winter seeding program, with good summer rainfall potentially seeing an increase in planted hectares.

While there is a lot of talk of increased canola area, barley plantings are still expected to be stable considering barley plays an important role in the crop rotation and continues to perform yield wise.

When looking at marketing grain that is left uncommitted, consider market liquidity and carry costs.

Strong pricing for wheat and canola at harvest time is likely to have seen the majority of these tonnes sold, while barley is more likely to have been the commodity that was held.

Assess your target price and how much upside you think is left in the market when committing remaining tonnes.

- More information: go to profarmergrain.com.au or call 1300 302 143.