In the wake of the August United States Department of Agriculture Report, wheat futures peaked in Australia on August 17, with a closing high of 775 US cents a bushel on the December contract, or in $A terms, a high of $A388.02 a tonne.

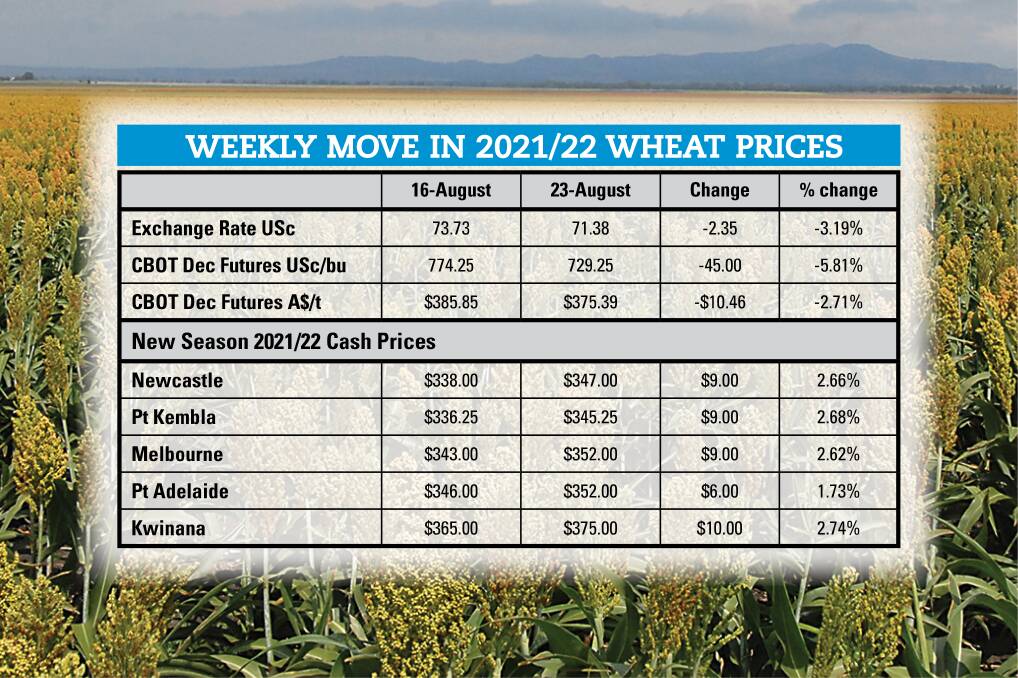

By the end of last week, December futures had shed 45.75 USc/bu (down 5.9 per cent), or $A12.62/t (down 3.25pc).

A major driver of the price declines has been a "risk off" attitude across most commodity markets in response to concerns about the latest global wave of COVID-19 cases. In the mix is a decline in crude oil, which has flowed through to biofuel feedstocks like soybeans (soyoil actually), canola and corn.

With last week's surge in wheat prices, wheat's premium over corn reached historic highs. As a result market commentators are expecting the corn market to hold more influence over wheat prices as we move forward.

Not only did corn come under pressure from global energy markets, the spring crop tour in the United States has placed the estimated US corn yield at a record high. This was another factor applying pressure to US corn prices, with a flow over to wheat.

If the corn yield assessment is correct, it may mean that the USDA has underestimated the size of the US corn crop. If that is the case, and production is revised up in the months to come, it will make it more difficult for wheat to recover to its most recent highs.

To put the current market into context, the current $A value of both nearby and December futures is at its highest level since early 2008. Since that time, it has been rare to have nearby futures above $A320/t.

The current price of $A367.67 on the September contract, and $A375.39 on the December contract, leaves Chicago Board of Trade futures in rarefied territory still, and this is reflective of wheat pricing elsewhere in the world outside of the US.

While we may have seen the high for the year (and that is by no means certain), and we may see prices continue to fall away, it remains likely that we will go into our own harvest with a very high price base, still well above the price levels of the past 12 years or more.

If we can add good spring rains across Australia into the mix, this year will be a very strong year for grain growers in Australia. It is not often that we have exceptionally high prices combining with strong production levels, if it all goes to plan!

And 2022? Just remember, high prices fix high prices. There will be a big incentive globally for wheat production to expand against the strong price signals being delivered at the moment.

- Details: 0411 430 609 or malcolm.bartholomaeus@gmail.com