MANY Australian growers are rightly rejoicing in a season of strong yields and historically high prices which will hopefully lead to strong returns for their businesses this season.

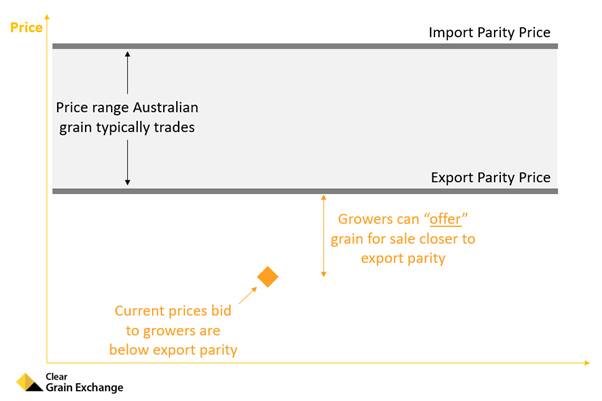

However, many analysts that monitor the real value of grain being offered from other exporter countries versus the value of grain bid to growers here in Australia, point out that current prices bid to growers are well below international values on an equivalent basis.

In other words, grain prices bid to Australian growers are currently below export parity.

So what's going on?

Some bearish and bullish factors are outlined below.

Bearish

- Buyers have some forward contracts on their books

- Australian harvest is confirming a large crop

- Many growers are selling at current prices

- Buyers are limited in how much they can buy now (funding constraints)

- Buyers are also limited in how much they can ship now (supply chain constraints)

Bullish

Values bid to growers are well under export parity - ie. prices from other exporting countries are well above prices bid to Australian growers on an equivalent basis

The world needs Australian grain - supplies are very limited from elsewhere till mid 2022

The full amount of grain to be exported from Australia this year has not yet been bought from growers

Harvest rains in parts of Australia are creating concern over supply of higher quality grades - ie. high protein milling wheats.

Australian exports of feed grains have grown significantly over recent years which could underpin values of any downgraded grain.

We have a big crop and we need to move it offshore, however the world also needs Australian grain right now and grower prices are as low as they have ever been compared to our international competitors (export parity).

This means the selling behaviours of Australian growers is likely to have the largest impact on the price you receive.

Sell a lot quickly by hitting published bids and our prices will remain under pressure.

Sell at a more moderate pace and offer grain for sale closer to export parity prices and grower values will likely be better supported.

My dad always said, "farm for five years not one year", referring to managing the good times and bad times in farming.

This approach instilled a value of aiming to maximise returns on the farm in any year to make sure the business' war chest was as strong as possible to withstand the inevitable harder times associated with farming.

Despite strong profits being a likely outcome for many growers this year, I can't help but feel we may be missing an opportunity to fully capitalise on the set of circumstances we have at present given grower bids are well below export parity.

We should be aiming to maximise the war chest in your business, particularly with higher input prices for next year.

Clear Grain Exchange provides a tool for growers and their agents to offer grain for sale at their nominated price so all buyers can see it and try to buy it.

Let's aim to ensure your grain sells closer to export parity and you're getting its full value.

- More infoormation: Go to cleargrain.com.au to offer your grain at your price on the independent and secure exchange or call 1800 000 410.

Want weekly news highlights delivered to your inbox? Sign up to the Farm Weekly newsletter.