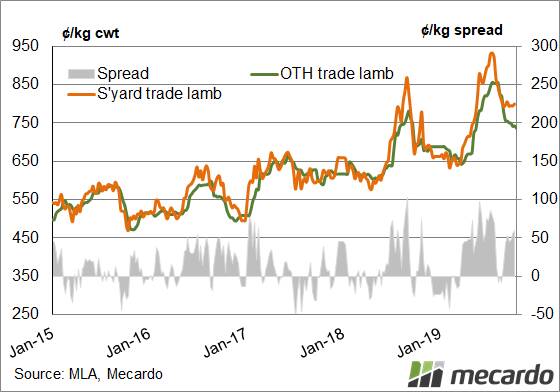

Saleyard prices often tend to run at a premium to over the hooks (OTH) prices, however, they appear to be lagging behind more than usual.

From 2000 to 2019 the average spread of saleyard trade lamb to OTH sits at a 12 cents a kilogram premium, in favour of the saleyard.

Annual average spreads over the last few years shows that the premium has widened from 10c in 2017, increasing to a 30c premium spread for 2019 (Figure 2).

During the first quarter of 2019, the spread was running at around a 20c discount.

In winter, however, the discount extended well beyond the normal historic seasonal range to see it peak at a 100c premium in June.

In October, the spread has widened again to sit above the normal seasonal range at a 60c premium.

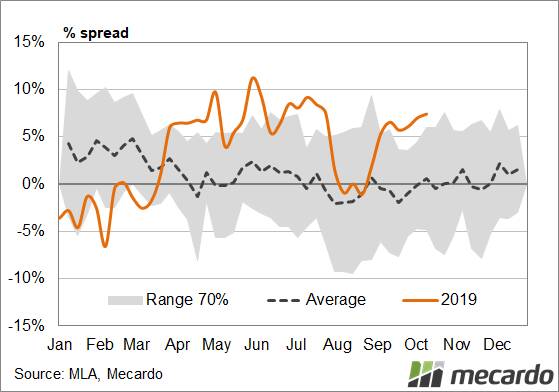

A more relevant measure of the spread behaviour is to assess it as a percentage spread value, as this takes into account the increasing value of the lamb over time (Figure 3).

While saleyard prices are have still been running at a significant premium through winter and October, they are only marginally above what is considered normal on a seasonal basis.

What does it mean?

In percentage terms, the long-term average spread from 2000 to 2019 sits at 2.5 per cent.

During 2017 and 2018, the spread was lower than the long-term figure at a 1.6pc premium.

During 2019, the average spread has been a 3.5pc premium and while it is elevated it is not excessively outside the normal variation that could be expected.

Start the day with all the big news in agriculture! Click here to sign up to receive our daily Farmonline newsletter.