ONE of the questions we have regularly had over the years:

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

"How many tonnes of X, do I need to sell to buy one HiLux/LandCruiser/Commodore compared to the past?"

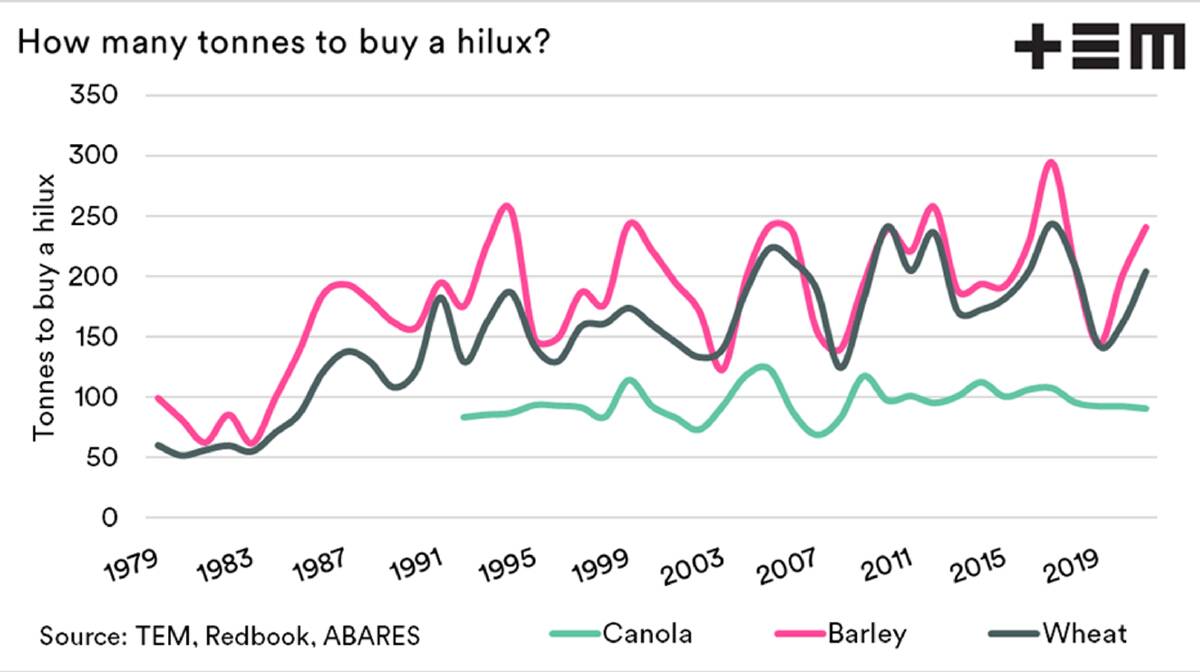

Let's look into how much grain you need to sell to buy one HiLux.

We chose the HiLux as it is a good quality farm ute which has been sold for a long time in Australia and will continue being so.

Sorry Commodore fans.

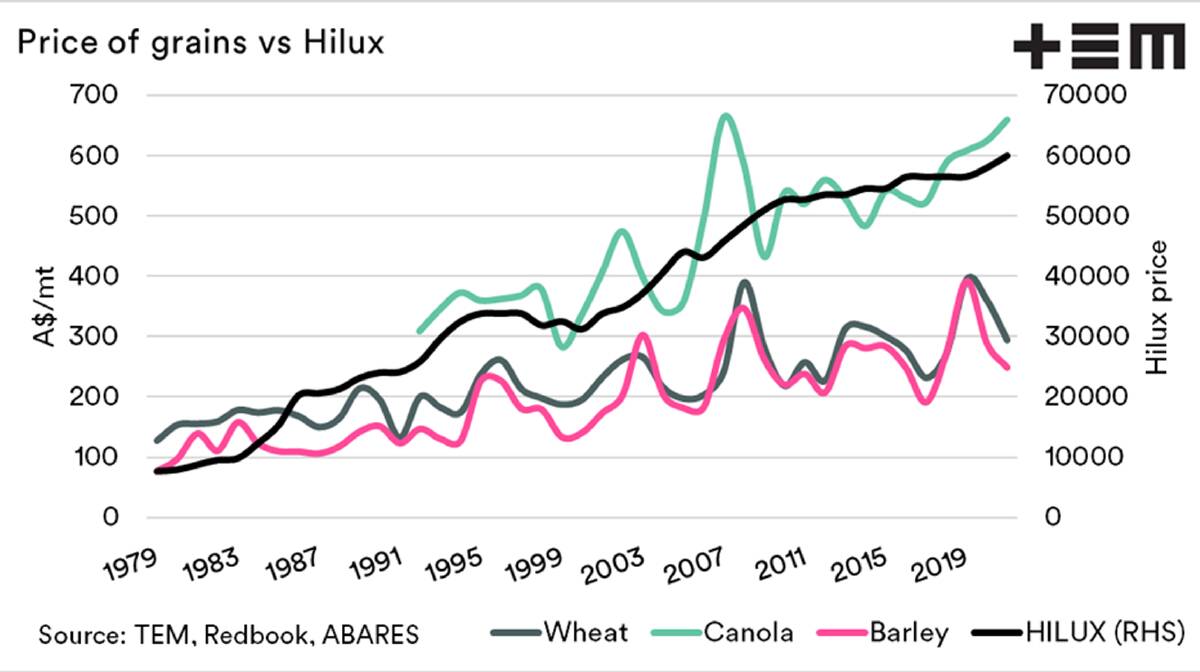

We gathered the price per year of a suitable HiLux from each year since 1979 to the present day, along with the annual average price for wheat, barley and canola.

Grain pricing has generally not kept pace with inflation, but everything else around us tends to increase in price.

The HiLux is no exception (even before the COVID-19 tax).

If you were selling wheat or barley to purchase a HiLux in the 1980s you would have a new HiLux after selling 87 metric tonnes (mt) of wheat or 99mt of barley.

In the 2010s you'd need to sell 197mt or 215mt respectively.

The story isn't quite the same with canola - the average decade range has been 91-100mt required to buy a HiLux.

Chart 1 (above left) shows the annual average prices of wheat, barley, canola and a HiLux

As we can see, the canola and HiLux pricing has increased at a much greater pace than that of wheat or barley.

Remember, the pricing in these charts is nominal, meaning they are the prices on the day and do not consider inflation (ie. the real price).

One of the reasons that the pricing of wheat and barley have only ground slowly higher over the decades is a result of productivity.

As an analyst, it's our job to look into the fundamental questions and delve in a little further.

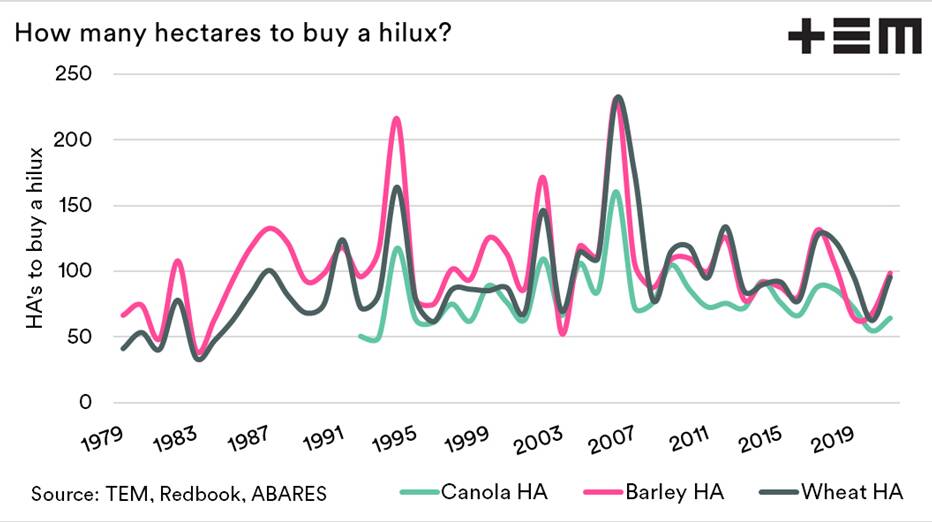

So what is the number of hectares required to purchase a HiLux?

We gathered the annual average Australian yield for each commodity and then calculated how many hectares would be required to purchase a HiLux.

This changes the story quite a bit.

It was the best time to buy a HiLux in the early decades, but the range since the 1990s hasn't been that large in terms of the number of hectares needing harvesting.

What does this analysis tell us?

The analysis shows the effect (or lack of) of inflation on pricing.

The price of a HiLux has gradually increased in price.

However, commodity pricing hasn't risen at the same pace.

The compound annual growth rate of a HiLux has been five per cent, whereas wheat has been 2pc and barley 3pc.

My next question for the industry and the agronomists out there is - can productivity keep pace with the costs in the rest of the world?