Elevated global demand for red meat, combined with tightening cattle supply in key producing nations, is creating a backdrop of ongoing rising prices and exceptional opportunity for Australian beef suppliers.

At the same time, the pandemic has torn shreds out of supply chain logistics that have served the industry well for decades and exporters are facing a juggling act the likes of which they have never before encountered.

International beef trade dynamics are as dynamic as they have ever been but industry leaders believe the sector is in fantastic shape and positioned strongly in the global market.

The Meat & Livestock Australia-produced State of the Industry Report 2021, released today, points to the global protein deficit in the wake of African swine fever, the signing of free trade agreements unlocking access to huge high-value markets and terrific production conditions in Australia as placing the sector in excellent stead.

It shows that over the past 20 years, total global consumption of meat has been steadily increasing at an average annual rate of 1 per cent for beef and 2pc for sheep meat.

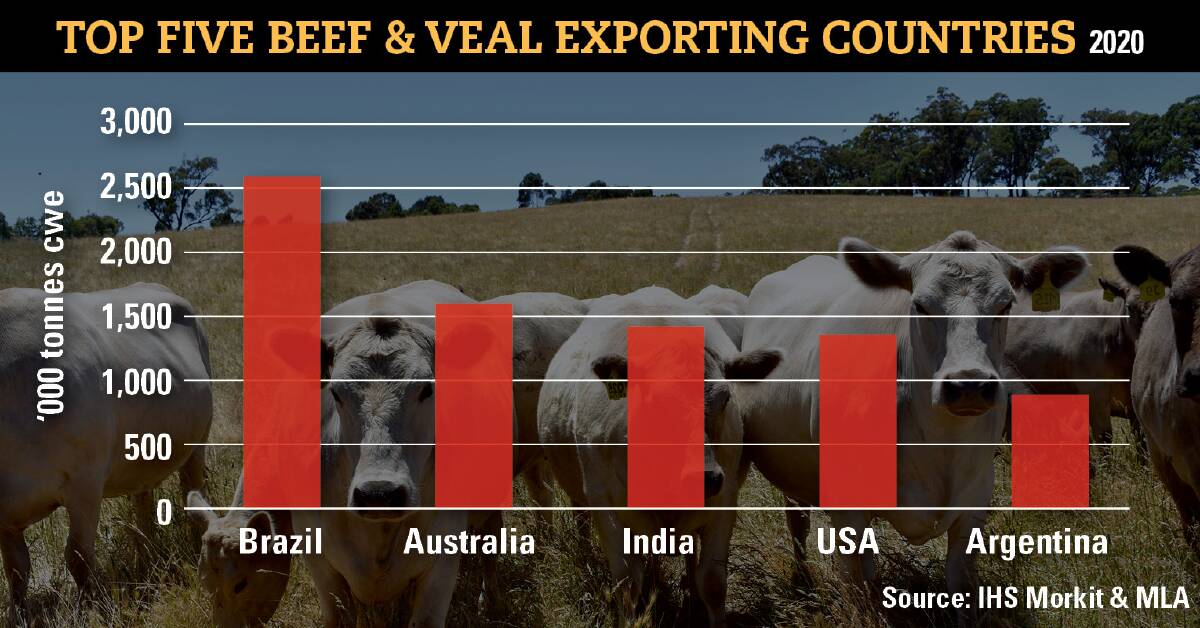

Australia is the largest sheep meat exporter and second largest beef exporter, behind Brazil, and red meat and livestock exports totalled around $18.4 billion in 2019/20, an increase of 11pc year-on-year.

ALSO IN BEEF:

Ironically, the job of getting the 70pc of Australian beef production typically sent overseas to customers has never been more volatile and those at the coalface say that means the make-up of our exports is fast-changing.

Global shipping and airfreight is in turmoil, with refrigerated containers in short supply, port congestion and shutdowns due to virus outbreaks, industrial action on wharves and prices through the roof.

Beef exporters are losing confidence in the ability to get their product to markets in a timely manner, particularly in the case of high-value chilled beef.

Turnaround times on chilled meat to California, for example, have gone from 35 days to as many as 70.

For family-owned exporter of premium organic meat, OBE Organic, decisions are being made almost on a daily basis around what product to send to what markets via which route.

Managing director Dalene Wray said it was unlikely air freight rates would ever return to where they were pre-COVID, therefore beef exporters had to choose their customers wisely moving forward.

"The decisions are around how to secure the most value for your product and what logistical choices will give you the confidence you can deliver to on time," she said.

"One point gone unsaid is what this may mean for the pipeline of new beef exporters coming through. A lot of experience and built-in resilience is now required to deal with the logistical issues of exporting time-sensitive products and they are compounding week-on-week."

Still, what Australia produces is clean, green beef that is safe and there would always be people around the world willing to pay more for that, she said.

"We need to ensure our diplomats maintain access to those markets," she said.

Meat & Livestock Australia managing director Jason Strong said Australian red meat continued to be recognised as a high-quality protein of choice across the globe.

"We have a premium product with a first-rate reputation that consumers are willing to pay top dollar for which puts us in a unique position and allows the industry to strive towards the ambitious goal to double the value of red meat sales by 2030," he said.

"Our job is to find the most discerning consumers both here and around the world and make sure they continue to be excited to eat our product - getting people comfortable with the fact that Australian red meat is a high-value, premium product should remain our focus. The combination of both value and consumption volumes contribute to the success of our industry."

Start the day with all the big news in agriculture! Sign up below to receive our daily Farmonline newsletter.