Agriculture might have hit a purple patch but new figures from the financial regulator and farmer surveys reveal it's taken some commodities and states extra time to get there.

The Australian Bureau of Agricultural and Resource Economics and Sciences surveys farmers each year to track their financial wellbeing and, together with figures from Australian Prudential Regulation Authority, the data paints a picture of performance.

The data looked at debt up to June 30, 2020 and found national agricultural debt was $83.7 billion, an increase of nearly 7 per cent, or $5.4b, in just 12 months.

It wasn't all about booming land prices. In short, some parts of agriculture were still struggling.

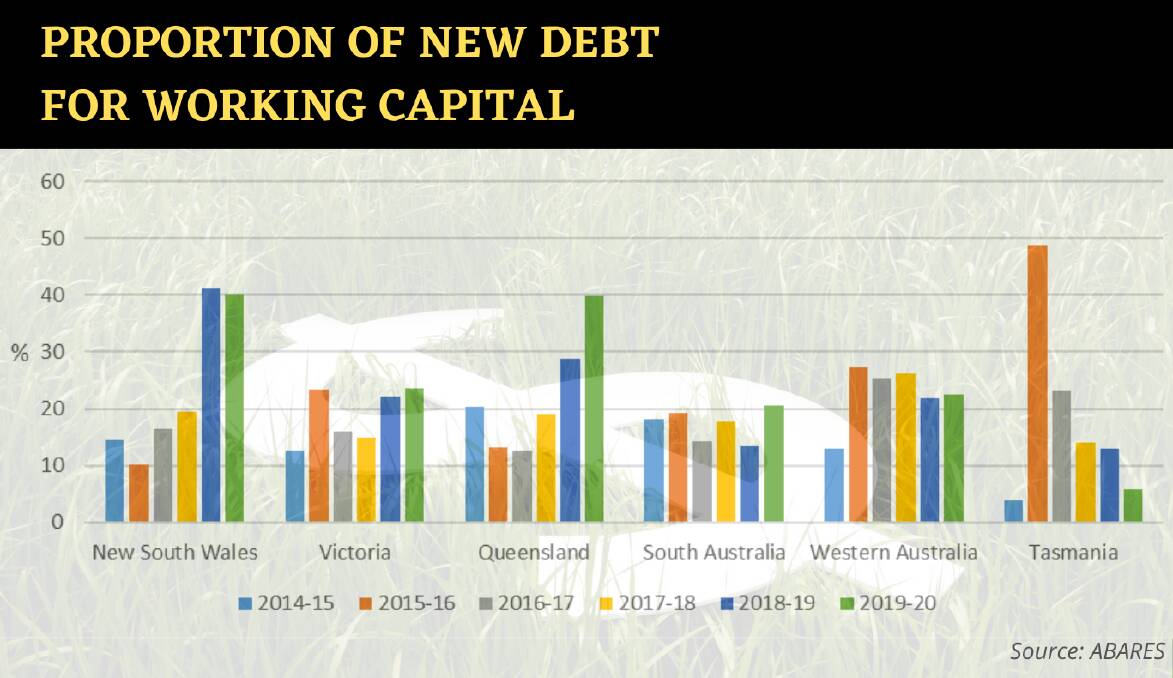

The drought left its mark on the numbers in New South Wales and Queensland.

In those two states, the proportion of new debt that was raised for working capital rather than land or machinery purchases was around 40 per cent in 2019/20, the biggest in Australia.

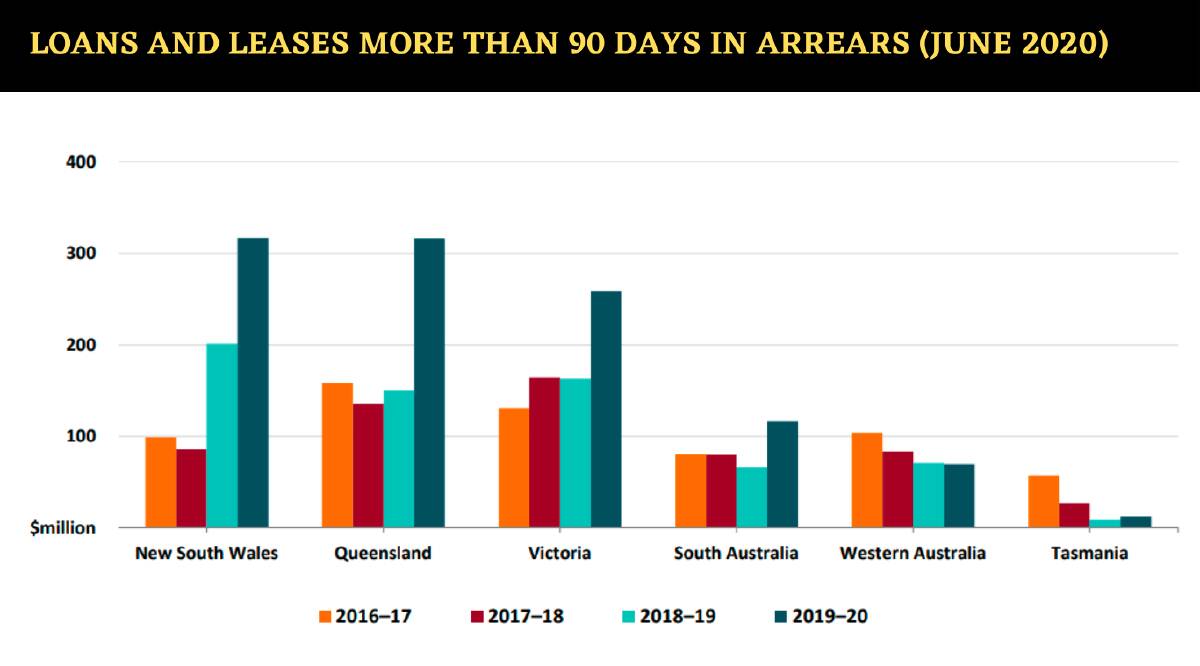

A second distress signal came in the form of arrears to lenders. Nationally, the value of loans and leases that were more than 90 days past due grew a massive 65pc to $1.1b in 2019/20.

As large as the national figures were, a deep dive into the data reveals farm businesses in some states were much more troubled than others.

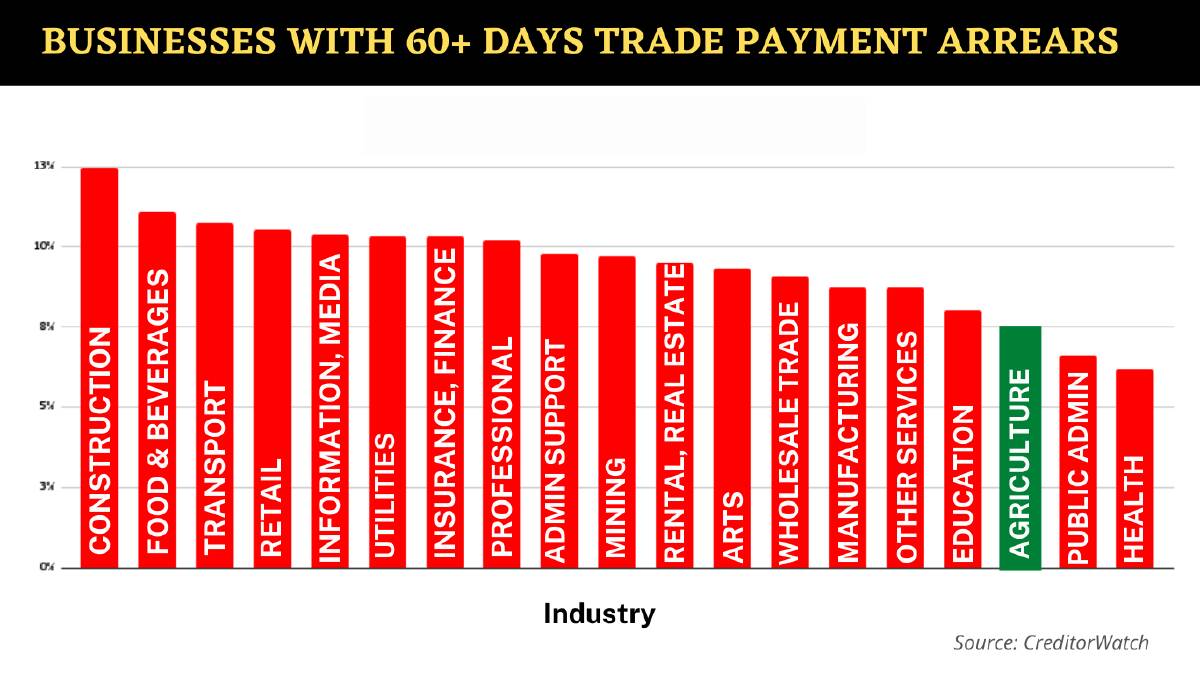

Although the next set of ABARES figures is months away, more recent data from CreditorWatch shows a recovery well underway.

The financial fitness advisor shows that farmers are a safer bet than almost any other type of business when it comes to offering credit.

The healthy state of agriculture in general has flowed on to the regions, with agricultural areas like Mackay, WA Wheat belt, Yarra among the best performers in Australia, according to CreditorWatch analysis.

READ MORE:

Want weekly news highlights delivered to your inbox? Sign up to the Farm Weekly newsletter.