THE young cattle market is finally starting to show serious signs of easing in line with what has been forecast as the herd rebuilds and more supply comes online.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

The Eastern Young Cattle Indicator fell off a cliff over the past week, going from pushing the 1200 cents a kilogram carcase weight level to finishing January at 1112c.

That was a drop of 79c, or 7 per cent, and a more seismic weekly shift than many of its upward jumps.

Restockers appear to be thinking the market is overheated, it's headed down and it makes sense to hold off buying for a bit, agents said.

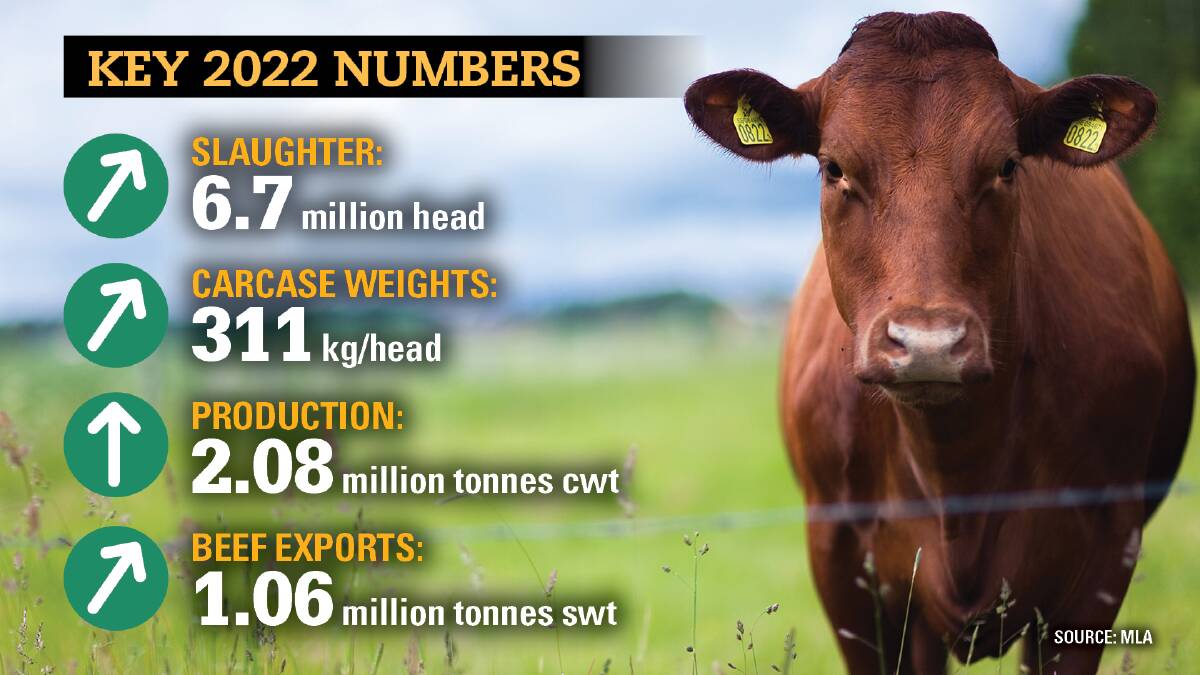

Meat & Livestock Australia's much-anticipated first cattle industry forecasts for 2022 were released today and tell a story of the continued herd rebuild and increased supply putting downward pressure on prices.

MLA's survey of industry analysts for price forecasts has the EYCI at 998c/kg at the end of June.

Thomas Elder Markets' fair value model has the annual EYCI average for 2022 at 828c/kg cwt, with a potential top-end range of 1020c.

This model calculates how historic demand and supply input values have impacted the price of cattle to issue a forecast based on current input estimates.

Despite the sharp easing during January the current EYCI level sits 9pc above the top of the modelled range and very much in over-valued territory, TEM's Matt Dalegleish said.

The heavy steer price also started the 2022 season over-valued, according to TEM modelling.

ALSO SEE:

Projections

MLA is projecting the herd to grow by 1.1 million head to 27.2 million this year as the rebuild continues. Slaughter numbers are forecast to rise by 11pc courtesy of the additional supply.

It will be southern herds driving that increase.

Queensland is only just beginning its rebuild, aided by excellent spring and summer rain, and the northern pastoral system requires a positive end to the 2022 wet season before its rebuild can begin into 2023.

MLA market information manager Stephen Bignell said the second half of 2022 should deliver a significant increase in supply as young cattle reach processor weights. Naturally, that places downward pressure on the market.

Unprecedented

Still, cattle prices will remain well above historical levels.

The beef industry is experiencing market conditions and confidence never seen before at a producer level, Mr Bignell said.

Agents and industry leaders agree.

Western Victorian independent agent Gary Chisholm said despite the big numbers of southern stock, particularly heifers, that have gone north, Victorian herds have retained the necessary numbers to move their rebuild along.

Come spring, he expects many areas in the south to be close to turning off normal numbers.

But that won't mean big price declines because demand is so strong from every corner, especially overseas markets, he said.

In more than 40 years as an agent, he said he had never seen anything like the current optimism in the cattle market.

"Australia won't be able to breed enough to keep up with demand for years, possibly never again," he said.

"We will build up to some reasonable numbers but that demand is across the board and only getting stronger."

NSW was a tale of vast differences in terms of herd rebuild progress, NSW Farmers cattle committee chair Deborah Willis, Taree, said.

"There are many still looking to cash flow who are taking advantage of the strong market - that sentiment of recovery after drought hasn't worn away yet," she said.

"So their herds are still well under capacity.

"Equally, there are other herds at full numbers already, where operators are now looking to expand and options such as buying more land are being looked at."

Nutrien's livestock lead for the south-east region Adam Mountjoy, based in Bendigo, said two favourable seasons and buoyant prices had left southern producers in a good position to rebuild and the desire was certainly there.

"We now have a parity-type situation where producers are well-aided by heavy cattle prices to pay premium values for quality young females," he said.

"There is a real buzz in the industry, everyone wants to be part of it. The kilograms are easily attained, and every kilogram is worth unprecedented money.

"People are looking ahead and seeing demand for our beef is not going away."

Indeed, the signs are that Australia's key beef export markets will continue to show strong interest, MLA analysts believe.

"As economies continue to recover from the pandemic and demand from the middle-income earning consumers grow in line with the increased population of these people, the export outlook for Australian beef is promising," MLA's cattle projections say.

"Challenges will remain, such as the macro issues including labour, shipping and logistics, as well as the potential for the Australian dollar to appreciate. However, overall, there are a multitude of positives for industry, particularly for the producer."

For all the big news in beef, sign up below to receive our Red Meat newsletter.