THERE are years where little happens; then there is 2022.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

Ukraine, drought creeping through the United States, and now China is seemingly stuffed.

China is often quite reserved when it comes to reporting on its crops.

A record crop in China is a bit of an in-joke within the industry, as it seems to occur every year.

Last week, the Chinese Agriculture Minister commented that the winter wheat crop could be the worst in history.

The Chinese government generally promotes a rosy view on domestic food production.

When the Chinese government say that conditions are bad, it's something to take seriously.

So I thought it was worthwhile diving into the situation and some of the data around China and grains.

While we tend to think of China largely in space as a large buyer, they are a very large producer of grains.

During the past five years, China has produced on average 18 per cent of the global wheat crop or 134 million metric tonnes (5.5 times our average production).

The majority of the Chinese wheat crop is winter planted ( 90pc).

Therefore, a disaster in the winter wheat crop bodes very poorly for overall production.

Through our contacts, it is expected that acreage will be substantially down.

The lateness of planting is likely to result in yield reductions.

This could lead to a substantial downgrade and a move from the 'record' levels that we typically hear of.

While they are a huge producer of grain, they do not export any substantial volumes except rice at 5pc of global trade.

They are the mouth of the world.

A huge population now eating a diverse diet has seen China as a huge proportion of the consumption of the world.

While they are a large grower, to meet their consumption demand takes large volumes of imports.

China is one of the world's most significant importers across various commodities.

The list below shows the average volume imported by China over the past five years.

- Barley: 8.3mmt

- Corn: 14mmt

- Oats: 297kmt

- Rapeseed/canola: 3mmt

- Soybean: 93mmt

- Rice: 4mmt

- Sorghum: 5.6mmt

- Wheat: 6.5mmt

While these numbers are large, they are the average over five years, and something has changed in China.

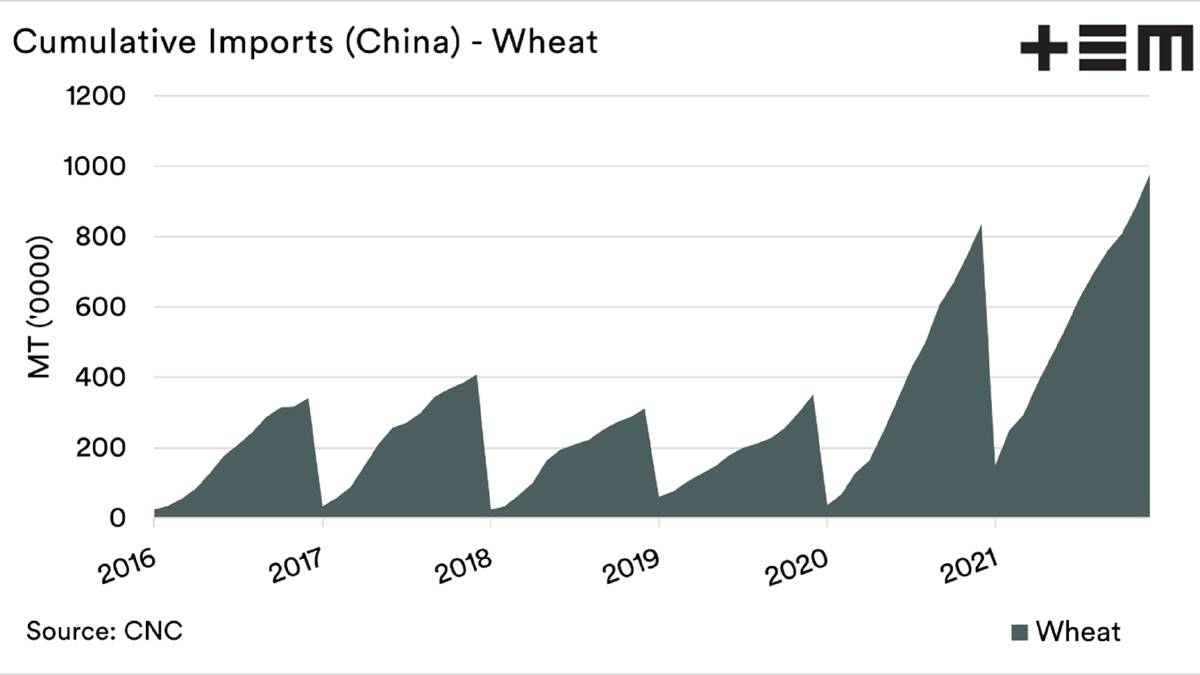

Chart 1 shows the huge increase in wheat imports during the past two years compared to the previous years.

We regularly update on the import volumes into China, as they are an important nation for Australian grains.

In 2021, they imported huge volumes of grains.

In 2020 and 2021, they have imported more than double typical volumes of wheat.

While they didn't import Australian barley, they have been willing buyers of Australian wheat.

China has always been an enigma, with solid data on agricultural production being relegated to rumours and whispers.

I had some concerns in the back of my head about the risk of China reverting back to prior import levels.

A major problem with the winter crop will likely lead to continued strong imports.

If their crop is in a terrible state, then they will have to start eating into the nation's stockpiles.

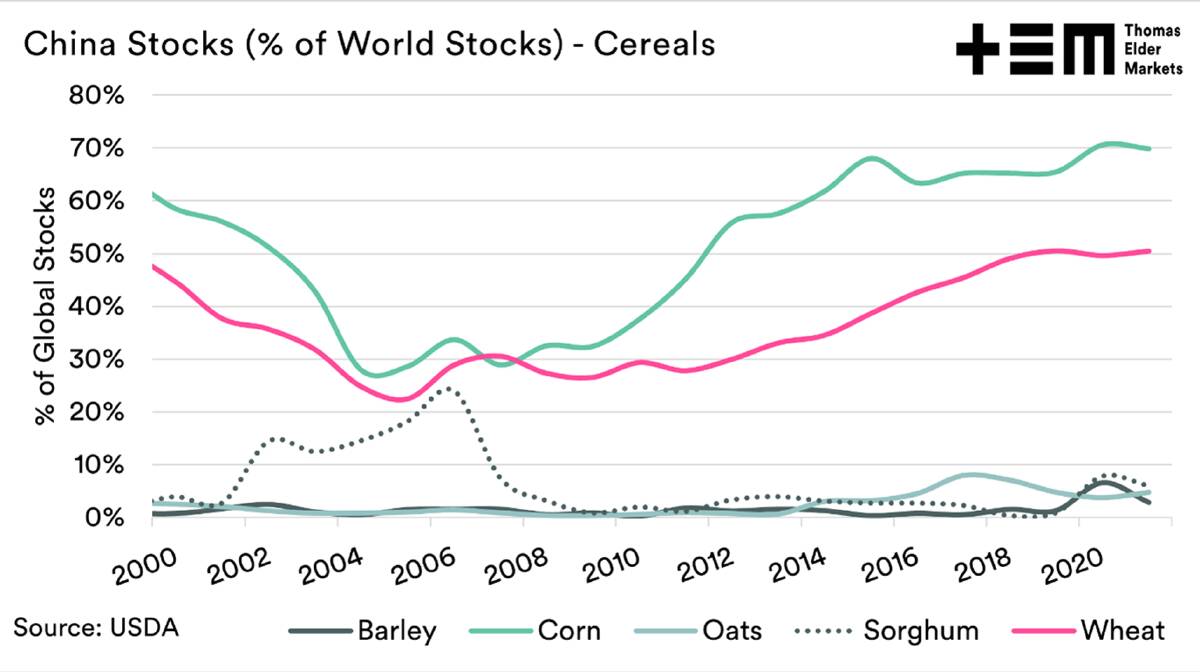

On paper, China holds 51pc of the world wheat stockpile (see Chart 2).

China has been hoarding a lot of grain.

I use the term on paper, as recent import programs may suggest that stocks are not as high as the Chinese government or US Department of Agriculture's data suggest.

If, as many suspect, the stocks are lower than government numbers suggest, this could point to another year of large imports.

If the import program continues, Australia is currently set to be in the front seat, provided Russia doesn't steal our trade after recent agreements between China and Russia.

Want weekly news highlights delivered to your inbox? Sign up to the Farm Weekly newsletter.