IT seems that we are in an endless cycle of positive news for oilseed pricing.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

First it was the Indonesian decision to ban the export of palm, now it is the turn of Canada.

We have been keeping a close eye on Canada.

At about this time last year was the turning point when canola prices were rising off the back of poor conditions within Canada, it was dry, and it was turning hot.

Earlier in the month, we wrote about how the subsoil moisture levels were not attractive.

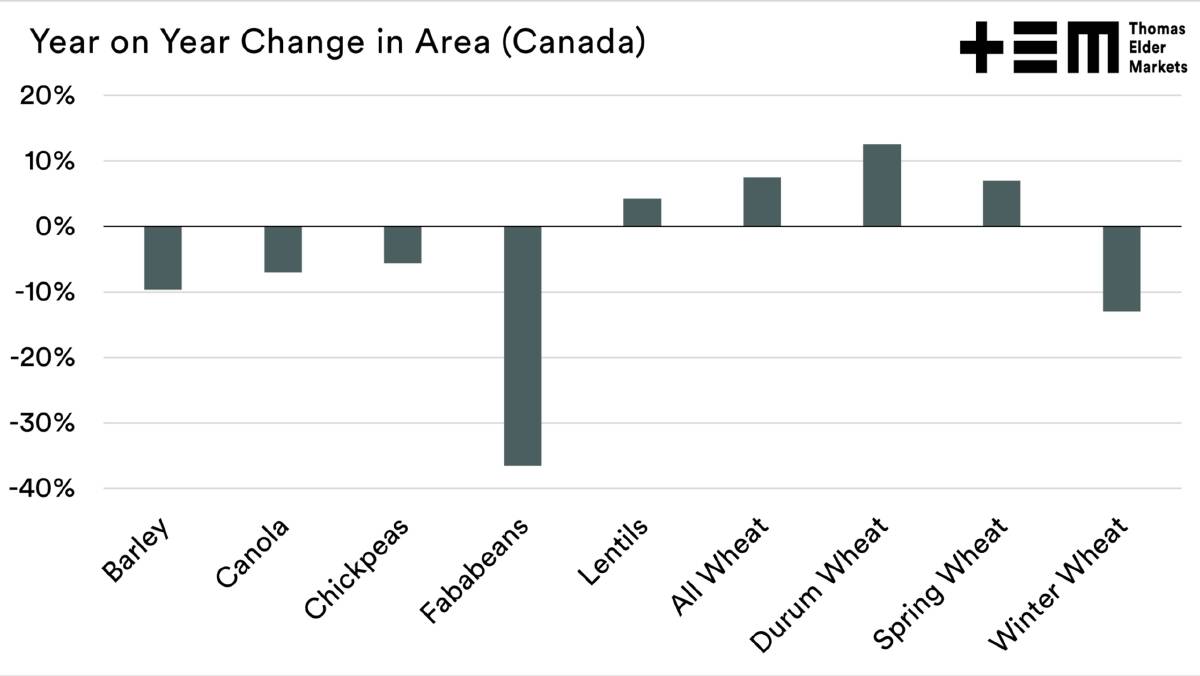

Statistics Canada released their numbers this week, and Canadian acreage is expected to drop considerably.

Year-on-year, canola is expected to see a seven per cent drop to 8.45 million hectares.

Interestingly this is only slightly lower than the 2011 to 2021 average, and 2010 was lower.

It does show that farmers are concerned about the dry conditions.

The extremely high pricing levels have not been enough to take the punt on increased acres.

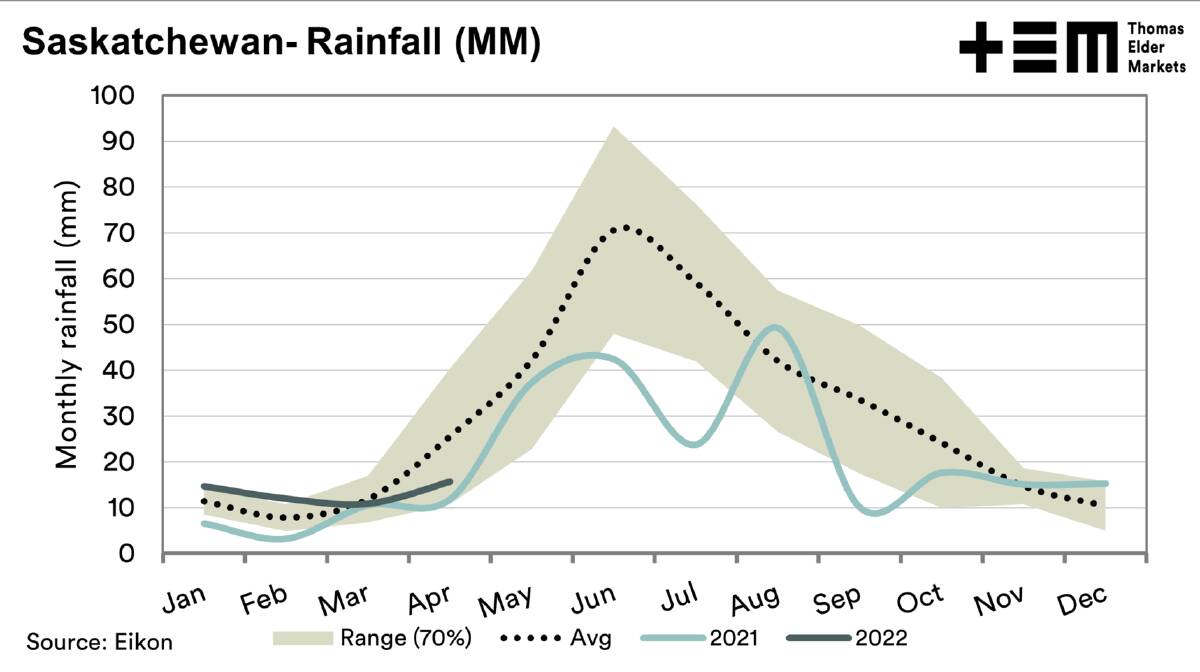

Chart 1 shows the rainfall for Saskatchewan.

At the end of April, rainfall has been lower than average.

They will need a good May/June.

Chart 2 shows a selection of grains and the year on year change, and we can see that spring wheat, the main grown type, has taken on most of the acres, not going into canola.

Canada is a huge competitor to us, and when their crop goes through tough times, it can be beneficial to us.

Want weekly news highlights delivered to your inbox? Sign up to the Farm Weekly newsletter.