YOUNG cattle prices continue to slide significantly but it's not purely driven by concern around foot and mouth disease, agents and analysts report.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

There are other elements at play dampening buyer enthusiasm at the moment.

They include the feeling the excellent run of seasonal conditions has to ease up soon, high grain prices slowing feedlotters' willingness to chase the market up and concern around processing ability on the back of the labour crisis.

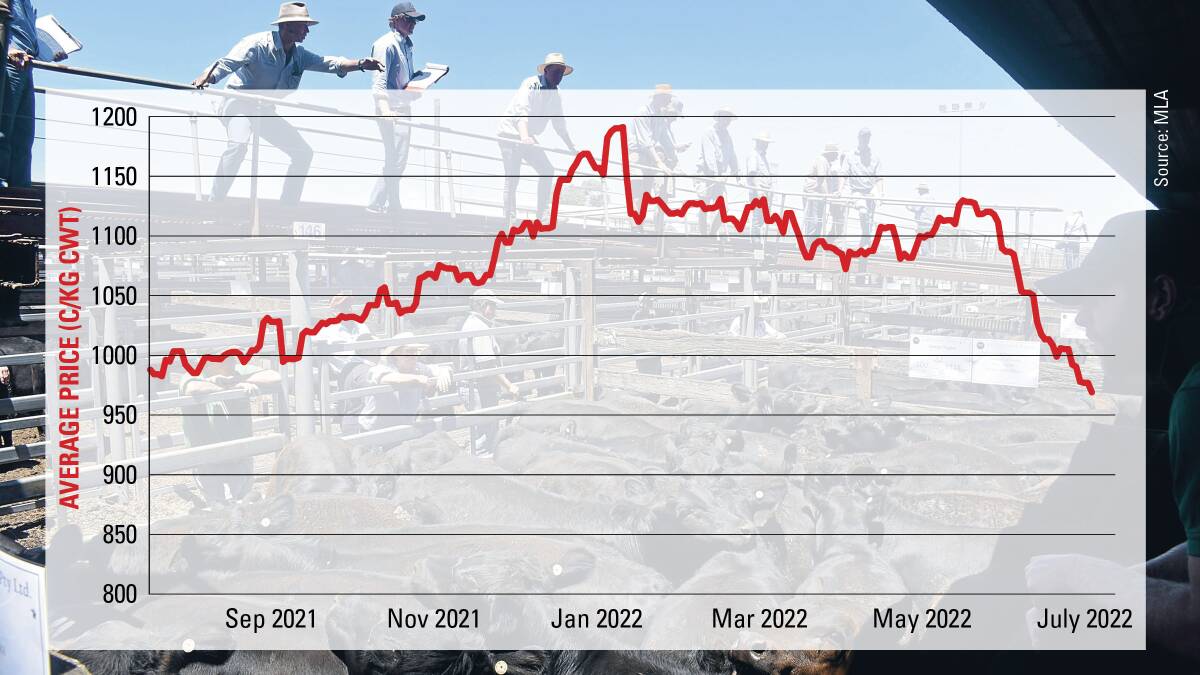

The Eastern Young Cattle Indicator has dropped 115 cents a kilogram carcase weight in the past four weeks, to sit today at 969c, which puts it 13c below the year-ago level.

Elders national livestock manager Peter Homann said there was a cautiousness creeping into the market around the threat of disease but it wasn't panic.

"Some who were due to sell a bit later on are bringing forward their stock and at the same time, buyers are taking a bit more of a wait and see approach," he said.

"Those dynamics will always soften the market."

Thomas Elder Markets analyst Matt Dalgleish said heavy steer prices had dropped to below $4 for the first time in a long while and the finished steer price tended to drive the cattle market pricing complex.

The prospect of turning a profit while paying big money for young cattle was tightening, he said.

The young cattle market had also dropped more dramatically in Queensland than in southern states, a sign of the downturn in live export demand, he said.

Trade to Indonesia for Australian cattle dropped by 28 per cent over June at a time when live-ex cattle supplies were typically peaking, Mr Dalgleish said.

"Some of those northern cattle are filtering into southern markets, putting some added pressure on prices," he said.

"FMD concerns are really only one part of the puzzle."

ALSO SEE:

South Australian agent Richard Harvie, PPHS at Naracoorte, said many restockers were taking a 'wait and see' approach.

"We're in the middle of winter anyway, and people are not flush with feed so to sit for six weeks is not a big issue," he said.

"The concern is around value. What will a $2000 purchase today be worth in six weeks?

"While many are thinking they'll hold off and minimise the risk, there is also the recognition that at the end of the day, if we don't get FMD, those who have kept buying will capitalise."

Northern NSW consultant Bill Hoffman said among his clients there were no radical decisions being taken on the back of FMD concern.

"Everybody is concerned but nobody is making significant changes to their program as a result," he said.

"People are doing what they can about it and getting on with business."