WILL they, won't they?

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

Since the middle of May, there have been a series of discussions between the stakeholders in the Black Sea region.

The nations in these discussions (Ukraine, Turkey and Russia), along with the United Nations, have been attempting to broker an agreement.

I can imagine that these discussions would be fraught with tension as the conflict still rages on within Ukraine.

The world wants Black Sea grain to flow freely, as it will reduce the humanitarian burden in third world countries, such as the middle and eastern African nations that are reliant on imported grain.

The expectations of Ukraine's opening have been one-factor placing pressure on the market over the past two months.

READ MORE:

Luckily, Australian wheat has weathered the storm (so far), with the market not falling as fast.

The export of grain from Ukraine has been massively affected by the lack of access to the sea.

This has relegated exports to the road and rail network into Europe, with the unintended consequences of the neighbouring countries having their supply chains pushed to capacity.

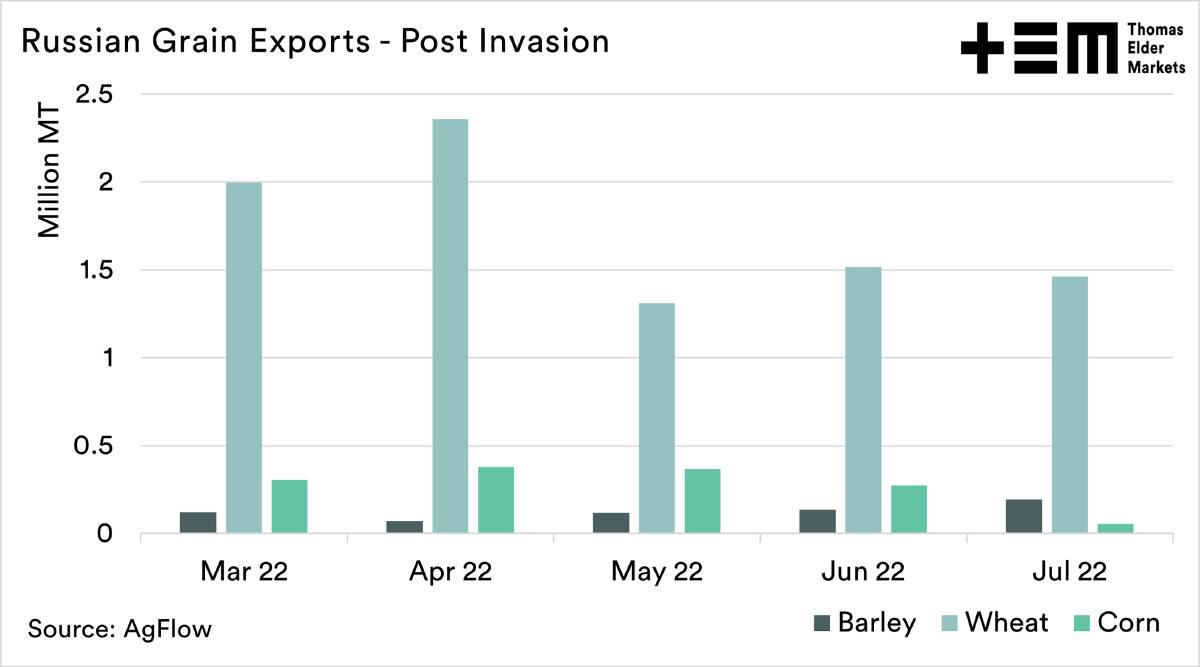

By looking at the data available through our partners at AgFlow, we can see the volume of grain being exported from Russia.

Note the United States Department of Agriculture has Russia exporting 40 million metric tonnes in 2022/23.

The agreement will see exports start from Ukraine under a sea ceasefire and with assistance from the Turkish navy (a North Atlantic Treaty Organisation member).

The additional supply coming onto the market from Ukraine could pressure markets, however, we would like to see the mechanics of this agreement and how it works in practice.

There will still be nervous shipowners, and insurance is likely an issue without solid assurances from all parties.