THIS is a rudimentary analysis that looks to provide an estimate of the overall costs to the industry.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

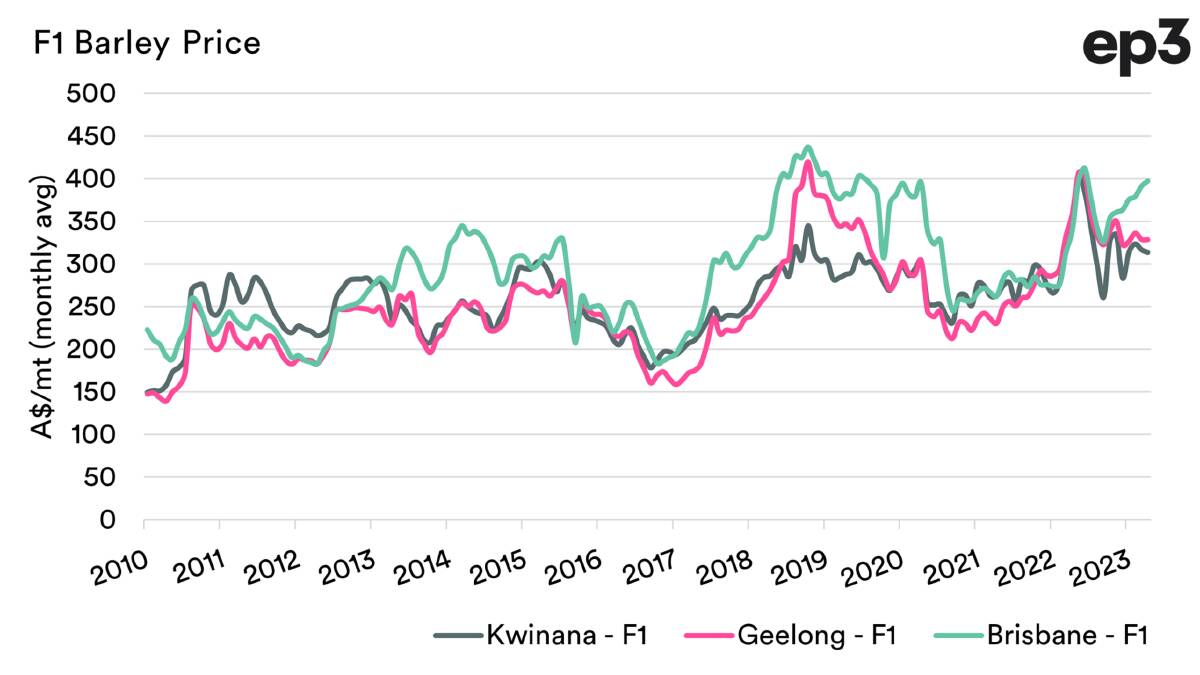

Flat Price

This is the term for the price that we generally see in the market and that a farmer receives.

If we look at the trend in pricing in the above chart, we had high prices during the last drought; then prices tended to crash around the time of the barley tariff announcement.

They then increased to strong levels in 2022, driven by the Ukraine invasion.

The reality is that farmers, since the tariff was announced, have experienced huge crops while at the same time receiving prices that were hitherto only achievable during drought.

So good news?

We avoided the impact of the Chinese barley tariff.

Let's look at some other comparisons.

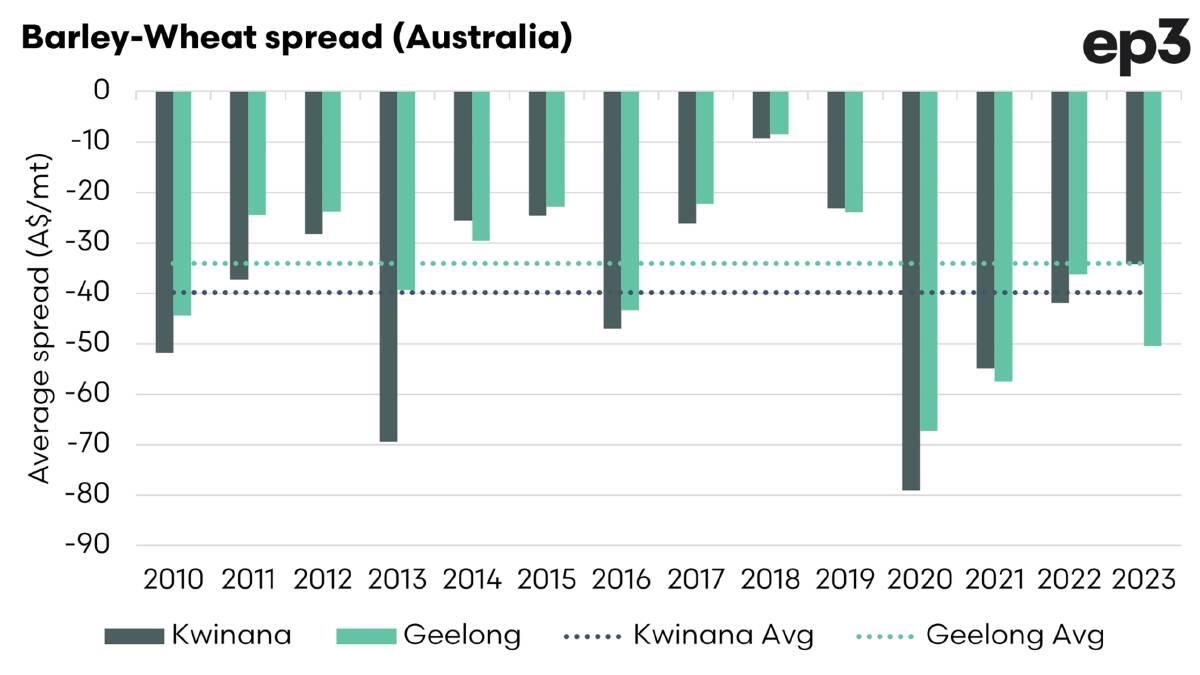

Barley-wheat spread

Not all is always as it is seen.

When looking at markets, you want to look at all angles and see what money is left on the table (or not).

One of those factors is the spread between barley and wheat.

Barley is typically higher in fibre and lower in energy compared to wheat.

It is also a good source of protein, but the quality of its protein is lower compared to wheat.

Barley tends to trade at a discount because it is inherently less attractive to feed (forget malt for a minute).

So we want to look at the trend in the above chart.

After the tariff was announced, the barley discount increased dramatically.

2020 is the largest annual average discount.

READ MORE LINKS:

It was only in 2022 that the spread started returning to average levels, although they blew out again in Geelong in 2023.

You could argue that 2022 was an outlier as well due to the events in Ukraine.

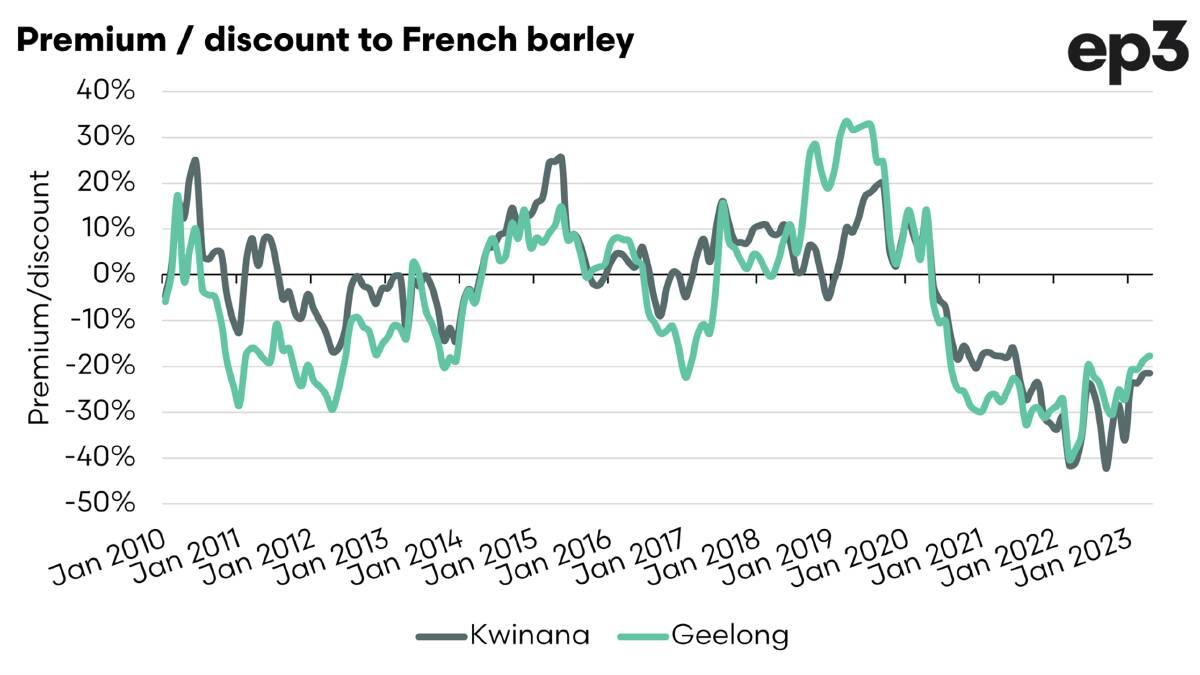

Our spread to our competitors

One of the big winners of the barley tariff was our farming brothers and sisters in France.

China wasn't stopping its purchases - it was going to another shop.

The trend is quite similar here to what we saw in the wheat-barley spread.

Aussie barley switched to a larger discount when the tariff was announced and has remained at a substantially higher discount than would typically be expected - as shown in the above chart.

The trend has remained at the bottom range of what would typically be expected when compared with France.

The Summary

There are many who say that the impact of the Chinese barley tariff hasn't been felt.

To an extent, this is true. Other events overseas have conspired to cause the price to be historically attractive.

I'll give that.

That being said, when we look at just these two comparisons, we can see that barley became discounted compared to typical levels.

There is an argument that a large part of the discount is due to the huge crops we have had, which has caused wheat prices to be depressed relative to overseas values.

However, barley has also traded at a further discount compared to our local wheat price.

My back of the cigarette packet estimate is that, on average, $20 per tonne to $30/t was lost due to the Chinese barley tariff - or between A$860m and A$1.3bn.

That's a fair bit of moolah.