Decreasing numbers of live sheep vessels and lengthy backlogs of sheep waiting to be processed are sparking fears that sheep numbers could decline further in Western Australia.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

Lake King wheat and sheep farmer Bob Iffla is among those who are concerned about a future without the live sheep trade will look like for Western Australia, as the federal government's independent panel continues work to chart a phase out plan.

"We're wondering if we should get out of sheep or not and there are a lot of people thinking exactly like me about sheep at the moment," Mr Iffla said.

"We'll be getting less than half of what we got last year if we have to sell them as mutton.

"We're usually selling May and June and we usually get rid of the last of them in July and that's when their teeth are just about to the wear line, so we can't hold them any longer."

Mr Iffla said each year they typically sell off 7000 Merino lambs to either the West Australian Meat Marketing Cooperative or as part of the live sheep trade.

"This last year we have sold about 2200 wethers to the live sheep trade and we can't sell any more to them because there's no more boats... unfortunately we still have a carryover of about 2500 wethers and we couldn't sell them last year as lambs because the abattoirs were absolutely full," he said.

"We've got about 12,000 lambs that are just about ready for market now but the lamb abattoirs cannot take them until probably August or a bit later and by that time our lambs will be too old.

"They will have to be sold as older sheep or we could have kept them over if the live sheep business was still going well.

"We've actually had to lease another property to run the wethers on until we can sell them."

The last sheep live export boats before the northern hemisphere summer months moratorium kicks in are now loading, feeding into the backlog.

According to Meat & Livestock Australia, WA lamb slaughter is operating 3 per cent or 20,500 head stronger than year to date 2022 levels, while sheep slaughter is up by 78pc cent or 238,000 head.

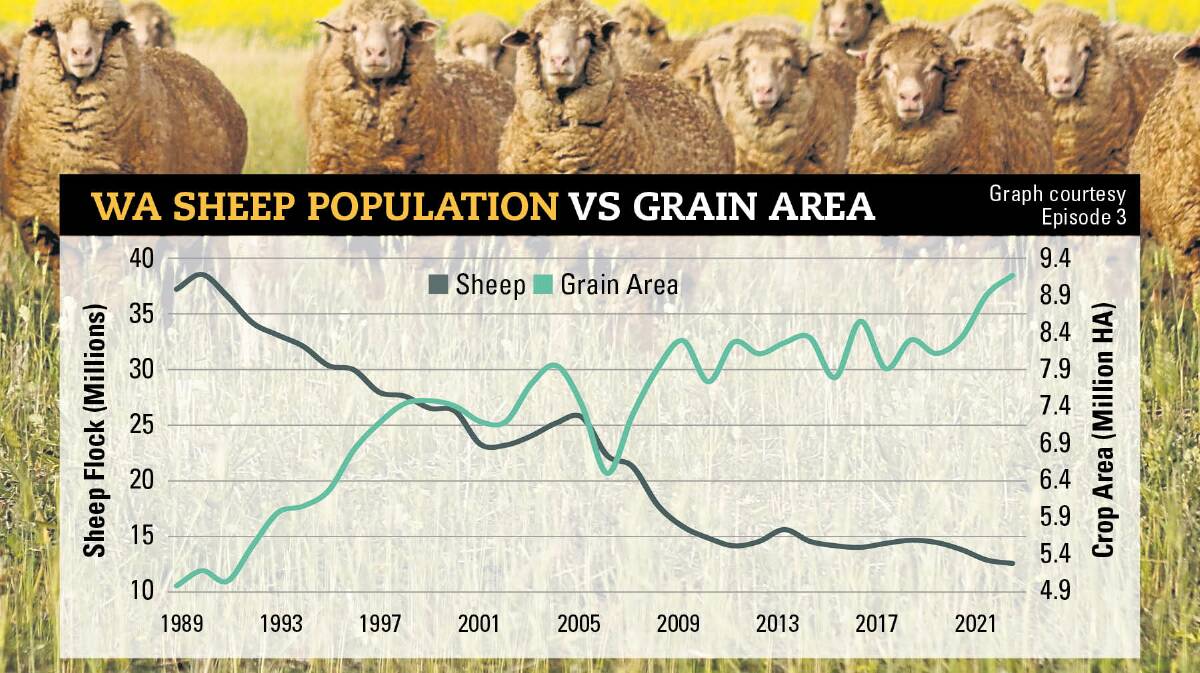

Episode Three market analyst Matt Dalgleish said in recent years factors such as high fertiliser pricing would have meant mixed farmers in WA saw the need to keep diversified enterprises to mitigate risk.

"Now with global fertiliser prices coming back down again... it is making people consider whether it's worthwhile staying in sheep with the uncertainty [around live export]," he said.

"The moratorium period's giving us a bit of an indication as to how pricing gets impacted when the live export buyer is not there and it's making a lot of people consider the future and whether they want to stay in sheep in WA for the long term."

Mr Dalgleish said while processors across WA had ramped up their capacity this year, further growth would take time and abattoirs were constrained by factors such as labour shortages.

Adding to the backlog is the levelling out of the numbers of sheep being sent east.

"In 2020 we started to see big numbers of sheep going across from the west to the east because New South Wales had come out of their drought and they were wanting to restock... that kind of created a false sense of security for the West Australian sheep producer because there were a lot of animals taken out of the market with 1.9 million going across in 2020," Mr Dalgleish said.

"During that year that was helpful to support the market in the west and therefore pricing was supported as well and the pressure on abattoirs for turnoff wasn't as great because of those additional numbers going east but that doesn't happen every year."

MORE READING:

Katanning-based WA Meat Marketing Co-Operative plans to spend between $70 and $80 million dollars to expand the plant to put on a second shift, driven by burgeoning demand for processing in the West.

As part of the plans WAMMCO has bought the Katanning Jumbuck Motel, which they plan to make the centre of a miner's style accommodation village once throughput ramps up.

WAMMCO chairman Craig Heggaton said they hoped to be able to increase the current throughput of one million head annually up to 1.5 million with the expansion.

"This could take us 18 to 24 months to get up to speed but we wish it could happen tomorrow because we've got a huge backlog of people wanting to get lambs in," he said.

"We've got quite a big waiting list and a lot of people we've had to turn away because we just can't handle them."

Mr Heggaton said they had the phase out of live sheep exports in mind and hoped the expansion would be able to cope with a good percentage of the stock that will need to find new markets.

"The majority of sheep that go on the live export trade are a bit more of a trade type, lighter body condition, but I think there are feedlotters who will certainly finish them," he said.

"Merino lambs that are well finished make a very good product."

Australian Livestock Exporters' Council chief executive officer Mark Harvey-Sutton said multiple markets for sheep were a necessity for a viable industry in WA.

"In fact, wool producers in the west will likely be the most heavily impacted by a ban on the live sheep trade," he said.

"When wool sheep reach the end of their productive life, a strong market is needed to underpin the value of wool production and that has been provided by the live sheep trade."

A Department of Agriculture, Fisheries and Forestry spokeswoman said access to both skilled and unskilled labour was a longstanding issue facing meat processors, being exacerbated by tight labour market conditions across the economy.

"These shortages are easing with the return of temporary visa holders and several government initiatives to improve the availability of workers including the provision of fee-free TAFE places," she said.