WHEAT futures are a tool that buyers and sellers of grain can use to manage their pricing risk.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

In reality, very few farmers in Australia use futures as a risk management tool.

But they are valuable, which is why we cover their use in our articles.

Generally, when people are discussing wheat futures, they will be referring to Chicago wheat (Chicago Board of Trade).

But that isn't the only option available to use.

There are many different futures exchanges around the world.

Read also:

When choosing a futures hedge, selecting an exchange with a strong correlation is advisable, as it is more likely to follow a similar trajectory to the local physical price.

If you choose an exchange with limited correlation, you could add more risk.

Correlations measure a relationship between two pricing points and a number is assigned:

- 1 = Perfect correlation

- 0 = No correlation

- -1 = Negative correlation

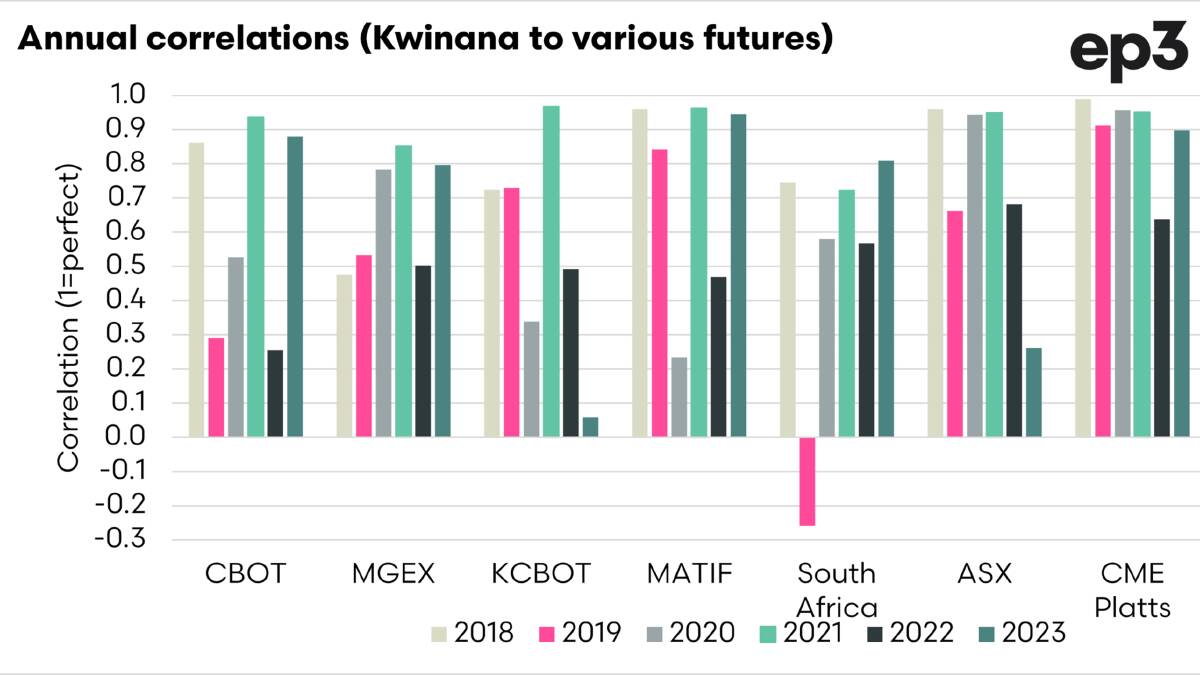

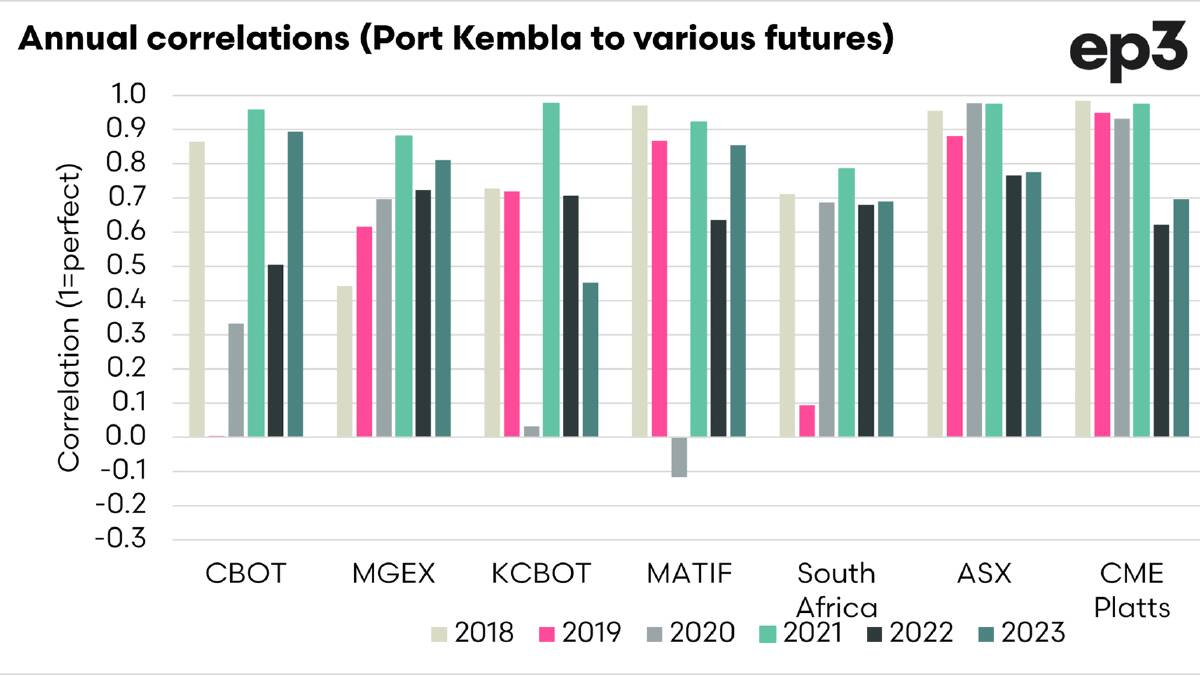

I have produced these charts, which examine Kwinana and Port Kembla APW1 prices against various futures markets on an annual basis since 2018, using monthly average data.

It is important to note that there is no perfect hedge for Australian wheat - even our local ASX contract is not perfect.

When deciding what market to use, examining which has the most consistency is advisable.

In Western Australia, the CME Platts WA contract has the highest consistency at a correlation of 0.9 during the past seven years.

Conversely, Port Kembla has the highest consistency with the ASX contract at 0.9.

This makes sense, as both these contracts are based on the local price.

It is important to note a few important factors when picking a futures contract.

Correlations don't always hold.

While it can over a long period of time, we can see years when the correlation breaks down.

Be aware of basis.

There is a basis risk using a local futures contract, such as Platts or ASX, but it is less than overseas futures.

Through locking in a futures contract based on the local market you reduce basis risk, but you also remove basis opportunity.