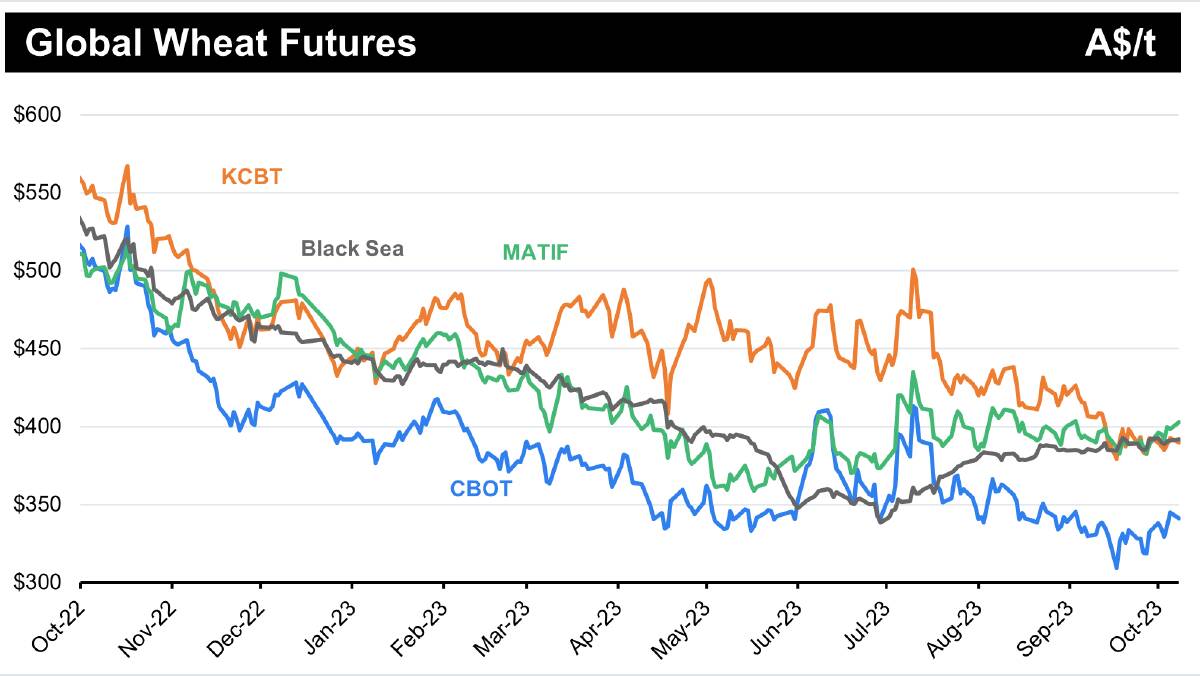

Prices of international grain and recent sales from Australia indicate prices of grain bid to Australian growers should be supported.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

China recently purchased approximately 8-900,000 tonnes of Australian wheat at US$295/t for APW1, US$313/t for AH2, US$285/t for ASW9 (min 9 per cent protein), and US$275/t for ASW1 on a free on board (FoB) ex Australia basis.

For comparison, these prices convert back to the following at an equivalent Australian grower level basis:

- APW1 A$430/t FIS WA and A$410/t track port eastern Australia.

- AH2 A$460/t FIS WA and A$440/t track port eastern Australia.

- ASW9 A$415/t FIS WA and A$395/t track port eastern Australia.

- ASW1 A$400/t FIS WA and A$380/t track port eastern Australia.

Other international price evidence in the past week includes the International Grains Council quoting APW1 and ASW1 ex Port Adelaide at US$312/t and US$300/t FoB respectively.

So a bit stronger than the China business above.

These international prices ex Australia seem to line up with FoB values ex other major destinations on a relative basis when accounting for freight and quality differences.

The values should provide us some confidence that Australian grain prices do not need to fall to remain competitive into international markets.

Particularly as we enter the northern hemisphere winter when exports can slow from exporters in the north and offshore buyers focus more of their attention to supply coming from Australia.

Australian grain prices now start to play a larger role in global prices, and how Australian growers sell their grain can have a large impact on Australian prices.

If growers sell a lot of grain quickly by hitting published cash bids, it can push grain prices lower.

An alternative is growers can offer their grain for sale at a price and let all buyers try to buy it, and in doing so, try to keep the market in balance and better supported, rather than pushing prices lower.

We are currently at price levels that enable grain from Australia to be exported from the southern States.

North eastern areas are trading at higher prices reflecting a freight premium to drag grain into those drier areas that require more grain to meet domestic use requirements.

How Australian growers sell their grain this harvest will have a large impact on grain prices you receive at the farmgate.

By the way, regular updates of international prices are reported in the Clear Grain Exchange (CGX) before market open commentary section written by Dominic Hogan.

This report is emailed every business day an hour before when CGX's market opens and is available to all growers.

For more information or to see what values are trading contact Clear Grain Exchange on 1800 000 410 or support@cgx.com.au