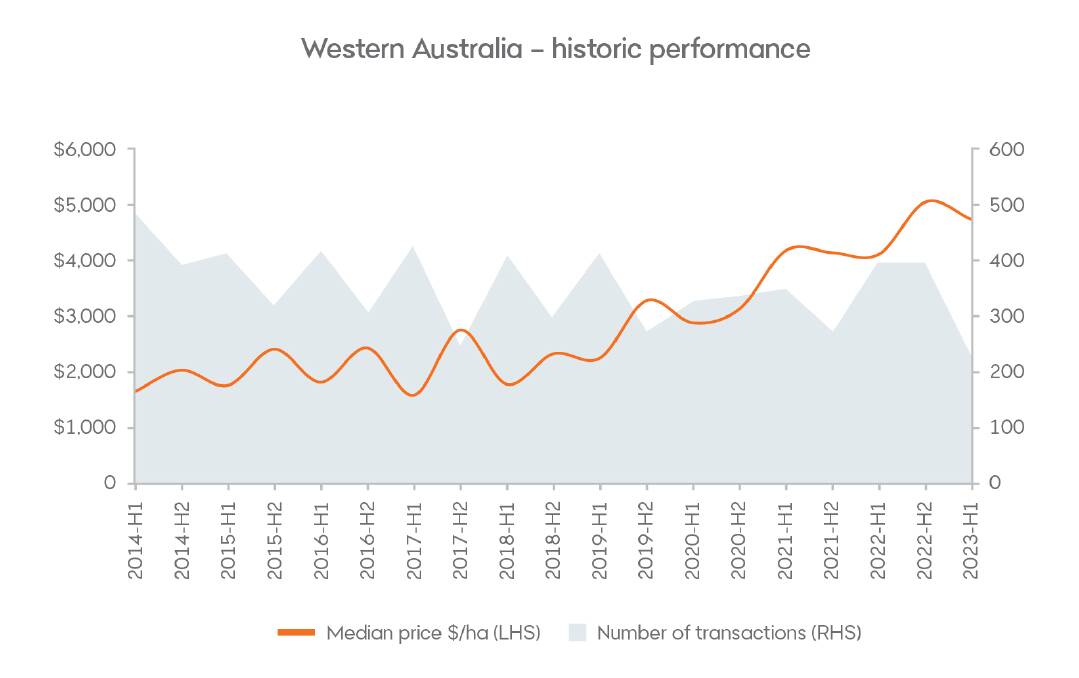

WA's median farmland prices have had the strongest year-on-year growth in the first half of 2023 of all Australian States and Territories - rising 15.1 per cent for the six months compared to the same period last year.

All WA regions, except the South West, posted an increase in values, according to new research from Rural Bank (part of the Bendigo and Adelaide Bank group).

Its Australian Farmland Values Mid-Year Update found WA farmland values have been on a strong upward trend in recent years, with the State's median price in the first half of 2023 up almost 170pc compared to five years ago.

Reflecting national trends, the first half of 2023 had the lowest number of transactions for a half-yearly period in a generation - the past 28 years - at 227.

Tight transaction volumes were a consistent theme across all WA regions, with year-on-year declines in transaction volumes ranging from almost 20 per cent down for the Great Eastern area to 72pc down for the Northern region.

Values in the Great Southern reached record highs during the first half of 2023, driven by a sharp decline in supply.

After posting two consecutive halves of declining values, the Great Eastern region rebounded with a new record median price.

In the Avon-Midland, the median price declined from the peak seen in the second half of 2022, but remained 3.3pc higher than in the first half of 2022.

Supply declined for a second consecutive half to the third lowest level in 28 years.

Central region farmland had the second largest percentage decline in median price, down from the record values set in the second half of 2022.

Half-yearly transactions were at their lowest level since 2021.

Values in the northern region declined from the record levels seen in the second half of 2022.

Transaction volumes plunged to the lowest level in 28 years.

In the South West, the median price increased 6.4pc - taking values back above $13,000 per hectare.

The South West was the only region to record a year-on-year decline in values.

Transaction volume followed the trend lower seen across all regions falling to its lowest level in 28 years.

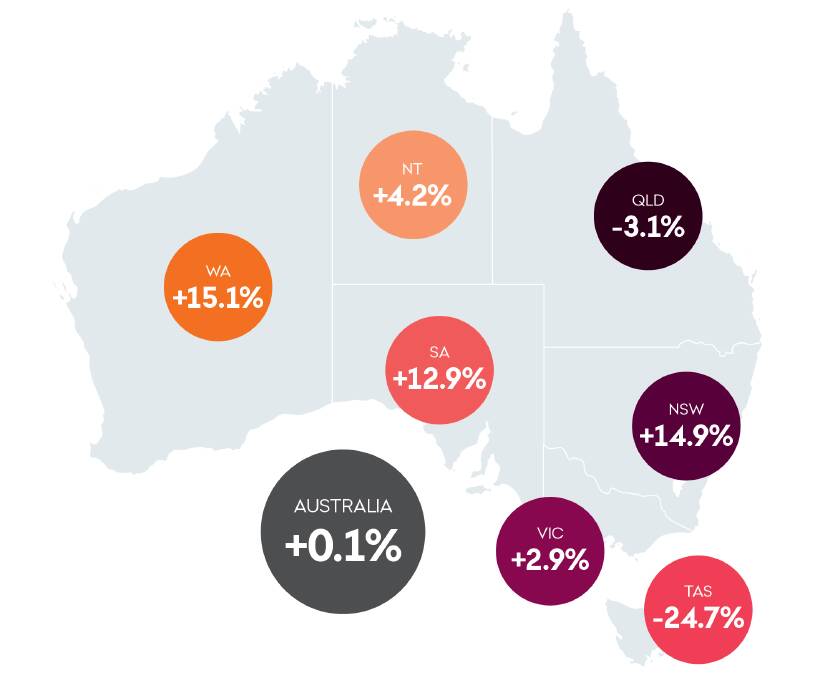

Nationally, there were extraordinary swings in farmland values between the States, ranging from a rise of 15.1pc in WA to a fall of 24.7pc in Tasmania.

The median price of Australian farmland in the first half of 2023 rose just 0.1pc higher compared to a year earlier.

As these sale prices cooled and demand for Australian farmland came off the boil - almost flatlining in the first half of 2023 - worried farmers sat tight on their land.

This was despite land prices still tracking at record levels in most States.

Rural Bank - one of Australia's biggest rural lenders - said its research shows the boom run of farm sales has ended.

Low sales volumes, which helped prop up the stellar prices, have now fallen to their lowest levels in the past 28 years.

Farmers waiting to offload land are praying for the early demise of El Nino, interest rate falls and a bounce in commodity prices, especially for livestock.

Nationally, Rural Bank property analyst Greg Kuchel said farmland transaction volumes were the lowest in a generation as potential vendors sat tight and more caution was exercised by purchasers weighing up their options.

Mr Kuchel said the "prevailing view" was that interest rates would hold at about current levels for some time.

The national median price of Australian farmland in the first half of 2023 rose 0.1pc compared with a year ago, Rural Bank said.

Good cropping land is in high demand in some regions, particularly WA and South Australia, but demand for grazing properties has cooled.

"There's simply less competition now with a smaller pool of prospective buyers," Mr Kuchel said.

Rural Bank said falling commodity prices (down 35pc from its peak in June 2022) and drier conditions meant less income and appetite from farmers looking to expand operations.

The bank's Farmland Values Report has tracked every farmland sale annually for almost three decades with extra data from Digital Agriculture Services.

Its mid-year analysis found after a sustained period of strong growth, farmland was more tightly held and prospective buyers were carefully reassessing purchasing decisions.

While the overall national trend was a lack of growth in land values, prices for cropping country generally kept pace with recent years with values rising in South Australia, WA and New South Wales.

"Demand in grazing regions was weakened by declining livestock prices and far weaker median price growth in Victoria and the Northern Territory, followed by negative growth in Queensland and a dramatic decline in Tasmania, largely confined to the northern region of the State," Mr Kuchel said.

The standouts, according to Rural Bank, were WA's Great Southern and South Australia's north.

Farm sales in South Australia's north recorded the largest rise in median price per hectare nationally, up more than 203pc in a year.

The Yorke Peninsula and Mid-North also performed strongly, both recording some stellar numbers for half on half transaction volumes.

Other regions to perform strongly were Victoria's Mallee, western Queensland and the New England and NSW's north west.

NSW was the only State to record growth from the second half of 2022 and has overtaken Queensland to have the third highest State median value per hectare.

It was up 14.9pc compared with the first half of 2022 and 12pc higher than second half of 2022 - with median values driven higher by strong growth in New England and North West, Riverina Murray and the North Coast.

Transaction volumes for the half-year were also the lowest in the past 28 years.

The median price per hectare of farmland continued to rise throughout the first half of 2023, with prices supported by this tightening of supply.

In Victoria there was more modest growth, but the most valuable farmland in Australia is still in Gippsland at around $25,000/ha.

The median price per hectare in Victoria remained higher than a year earlier in the first half of 2023 - but fell from the record level of the second half of 2022.

The Mallee was a highlight - up more than 46pc year-on-year - as was the Wimmera and Ovens Murray region with solid growth, but transaction volumes were also down.

The median price per hectare for Queensland farmland fell in the first half of 2023, representing a year-on-year decline of 3.1pc and a 4.5pc fall from the last half of 2022.

Before 2023, it had experienced a four-year run of rising median price.

In South Australia, the Adelaide/Fleurieu region has the third most valuable farmland in Australia at $17,500/ha and the State's median price per hectare was 12.9pc higher year-on-year.

The north South Australian region saw the largest rise in median price per hectare in the nation, driven by a substantial rise in median prices across cropping properties, in particular.

Rural Bank expects falling livestock prices will weigh on the grazing property market over the back half of 2023 - but in Murray and Mallee, values lifted to record levels over the first half of 2023.

Half-yearly transaction numbers were also lower year-on-year, though were still the second highest recorded since 2017 - and median prices across the Eyre Peninsula also continued to trend higher.

North west Tasmania has the second most valuable farmland in Australia - but Tasmania still recorded a decline in the value of farmland in the first half of 2023 following an exceptional period of growth in the previous three years.

The median price per hectare in the first half of 2023 was 24.7pc less than a year earlier - a distinct shift from the previous three half-yearly periods which had year-on-year growth ranging between 15-33pc.

Northern Tasmania's median price fell dramatically in the first half of 2023, to its lowest point since the second half of 2019 but this decline may reflect the low number of sales - being low-value grazing properties - rather than of an overall substantial decline in property values in Tasmania.

--