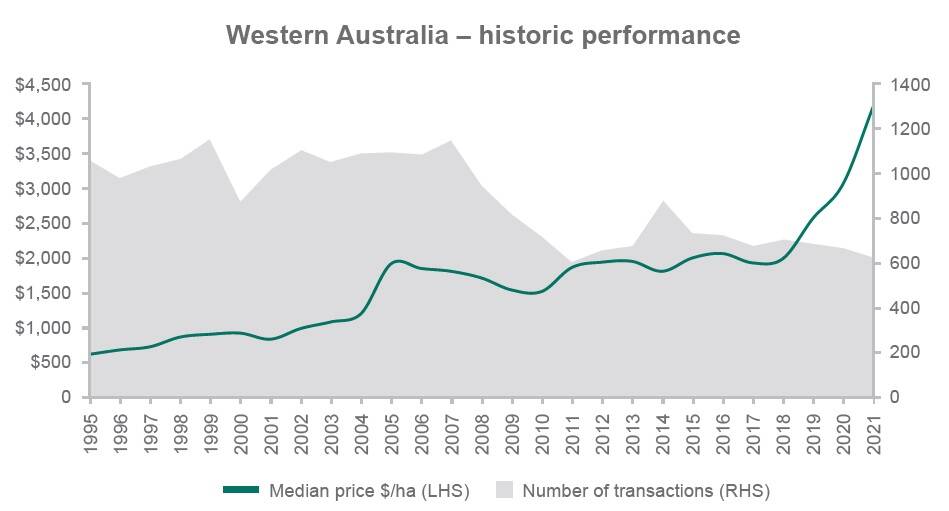

A record grain harvest helped propel Western Australia's farmland sales further into record country.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

Tight supplies of rural property available for sale and above average commodity prices pushed the median price per hectare to $5121/ha.

The total value of all land sold in 2022 was $895 million, a rise of 27.5 per cent from 2021.

It marked the fifth consecutive year of growth.

This is the analysis of one of the nation's biggest farm lenders, Rural Bank (part of the Bendigo and Adelaide Bank group) which says nationally, a number of market "headwinds" have softened the market.

The bank found despite a decline in transaction volume the area of land sold across WA rose 8.5pc to almost 359,000ha in 2022.

The increase in large parcels of land traded in the Central and Northern regions was responsible for the rise, the bank's report said.

WA farmland values have grown in 10 of the past 12 years to see farmland values among the top performers in the country.

The growth in median price per hectare was seen right across the state except for the South West where values were flat year-on-year but remained near record levels, the bank said.

The Central region recorded the state's strongest growth for the second year in a row with a rise of 59.8pc in 2022 on the back of a 52.1pc rise the year before.

The other two regions to show exceptionally strong growth were Avon-Midland with a 49.1pc increase and the Great Southern region rising 30.2pc.

The Great Eastern region recorded a 6.8pc rise in median prices which was a sharp pullback from the 50.6pc seen in 2021.

The median price was pulled down by lower prices for large parcels of land above 900ha.

The total volume of farmland changing hands across the state fell by 27.6pc to a 28 year low of 452.

All regions across the state recorded a decline in transactions except for the Central region which saw an increase of 17.3pc.

READ MORE: National demand for land to continue

Rural Bank said the sharpest fall was in the Great Southern region which had 51.3pc fewer transactions in 2022.

Simon O'Leary, Rural Bank, Western Australia said: "WA farmland prices continued their upward trajectory in 2022, marking the fifth consecutive year of gains and reaching record levels.

"This remarkable performance underscores the sustained demand and robust investment potential in the region's agricultural sector.

"Despite challenges such as high input costs, continued tightness in the labour market and rising interest rates, the market demonstrated resilience, showcasing the enduring appeal and strong investment value of Western Australian farmland."

"Rising borrowing costs and softening commodity prices will likely weigh on demand in 2023, limiting growth prospects in comparison to the past year."

While analysts say land prices will keep rising it will be at a slower pace to signal the end of the record run.

Only a tightened supply of farms for sale last year kept those headwinds at bay and saw yet more price records.

The bank points to an "inflection point" to finally slow the growth in values recorded right around Australia.

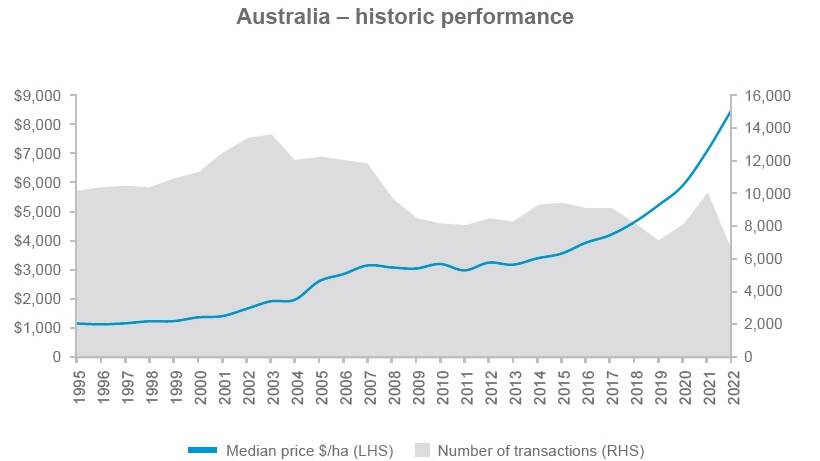

Farmland sales last year equated to 8.8 million hectares of land valued at $11.7 billion.

READ MORE: See our list for big property sales in 2022

For comparison, wheat exports from last year's bumper harvest have been valued at $14.2 billion and in 2020-21 red meat and livestock exports totalled $14.6 billion.

The amount of land which changed hands is similar in size to a European country such as Hungary.

The bank's annual deep dive into Australian Farmland Values said some of the drivers of the farmland price boom in recent years had changed.

Tracking every farmland sale annually for almost three decades, the 2023 Rural Bank report is the longest running analysis of the farmland market in Australia.

Interest rate rises are starting to bite, agricultural commodity prices began to fall during the second half of 2022 plus the cost of key farm inputs hurt cash flows.

Although, as Rural Bank's analysts point out, farmland values are still expected to rise as demand still outstrips supply but not to the same extent as recent years.

Rural Bank's head of agribusiness development Andrew Smith said: "While there was enough momentum to sustain growth in farmland values in 2022, the continuation of these headwinds into 2023 could begin to drive a slowdown in growth."

Mr Smith said it was unlikely farmland values had yet peaked or were headed down.

"Rather, the new level of interest rates, downturn in commodity prices and potential for a drier finish to 2023 points to farmland values reaching an inflection point.

"Growth is still expected in 2023, albeit at a slower rate than the previous two years."

The Rural Bank report said farm land prices kept rising last year for the ninth consecutive year.

Land prices jumped another 20pc last year, following the 20pc rise the year before.

The national median price per hectare for Australian farmland is $8506 per hectare.

According to the bank's many years of data, farm prices have risen by 167pc in nine years.

Hold onto your broadbrimmed hats, the Northern Territory recorded a stunning price growth of 108pc.

Across the states in 2022, Tasmania soared on its median price per hectare with a 54.9pc lift.

Victoria, South Australia and Western Australia all recorded growth of more than 20pc closely followed by Queensland and NSW with increases of 15.9pc and 18.9pc respectively.

According to Rural Bank records, was the first time growth of over 15pc was recorded across all states and territories in 28 years..

The supply and demand equation came into play as the number of farm properties available for sale last year fell sharply.

Nationally, the number of farmland transactions fell by 34.3pc to 6588 - the lowest level of transactions in 28 years.

Across the states, falls in sales ranged from 13.8pc in Tasmania to a 44.6pc fall in Victoria.

South Australia was the only state to record an increased number of transactions in 2022.

Don't miss out on all the latest rural property news. Sign up to receive our free twice weekly Farmonline property newsletter.