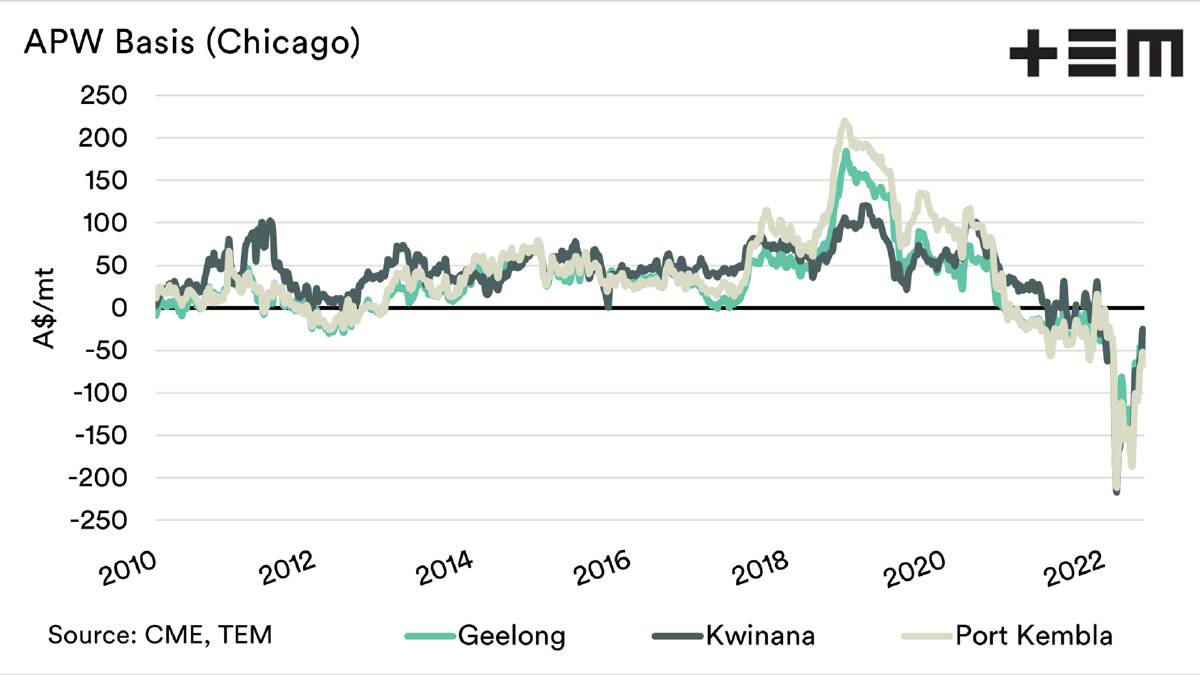

BASIS is a good indication of the relative value of our grain versus the futures markets.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

Although many like to overcomplicate, it is literally just the difference between the futures price and a local physical pricing point.

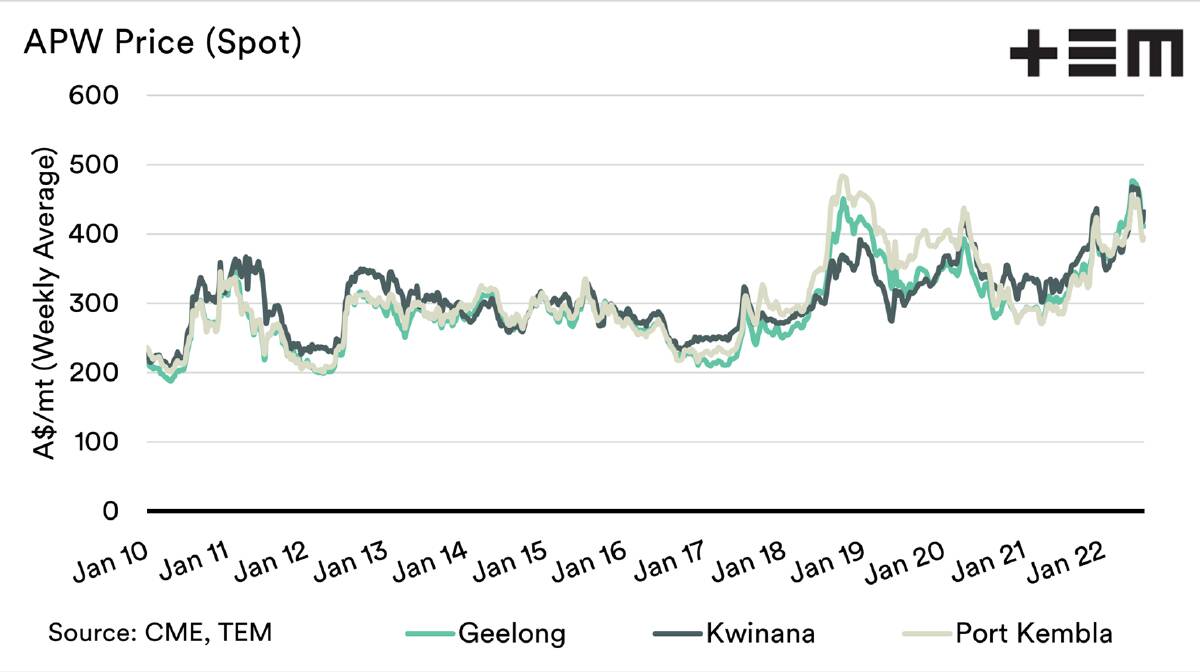

Historically speaking, the price of wheat locally in Australia has been very high.

The chart above shows the flat price (basis, futures and fx) from 2010 to the present.

This is essentially the price farmers receive.

The key point is prices are as high now as they were during the 2018-2019 drought.

This is a great because at least farmers have something to sell.

High prices with no supplies is not a great scenario.

During the past two months, the futures price has declined, however the pace of fall in local pricing has been less.

This has allowed basis levels to return closer to a more normal level.

The encouraging thing is the basis levels for new crop have improved significantly.

Last week, our pricing levels in many areas were at a premium to the Chicago Board of Trade.

The big question will be how big the Australian crop is - if we have a big crop, we will expect basis levels to languish.

However, the good thing is that while we didn't get the full value of the rise in futures in recent months, we have recently not had the full punishment of the fall.

READ MORE: