WHEAT prices in Australia are historically pretty attractive.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

There is no denying that.

However when looking at markets, it is important to check on how our prices are relative to other origins.

A term that is often confused in the industry is basis, to simplify this term - it is just the difference between two prices.

- Subscribers have access to download our free app today from the App Store or Google Play

In this article we will look at ASX wheat (to represent Australia) and Chicago Board of Trade wheat.

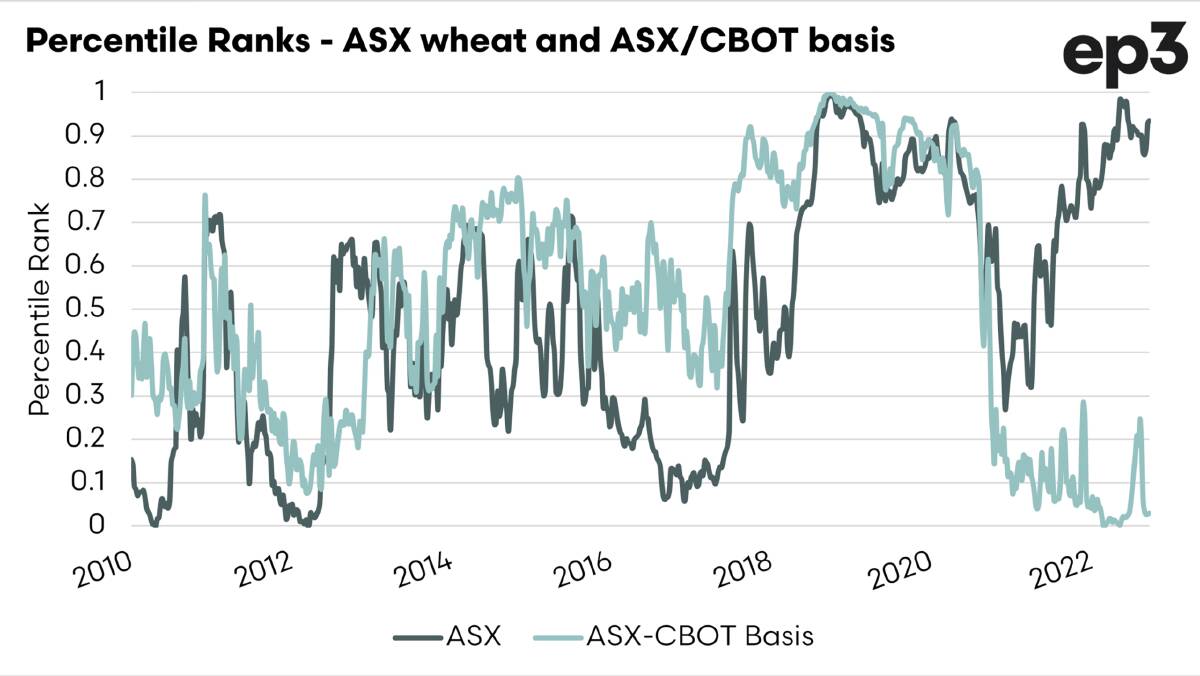

To look at how our basis compares to history, I have opted to display this as a percentile ranking.

A rank of 1 equates to the highest basis level (or premium) and 0 equates to the lowest basis level (or discount).

The chart below shows the basis has improved in recent months but remains particularly low compared to history.

The basis level will tend to be higher during times of drought, when supply is low, and tends to be discounted during times of excess production.

Our basis is generally our 'domestic premium/discount'.

A high premium is not necessarily great, as it indicates very little to trade.

What the chart shows us is that the actual price is high compared to historical levels, which is converse to the basis level.

MORE GREAT READS:

To an extent, Australian producers have been saved by events overseas which have caused the overall price to rise (a rising tide lifts all boats).

If events overseas had not caused the market to rise, we could be at a discount from a lower starting price.

It's all swings and roundabouts.